Network tokenization—also known as tokenized payments—is revolutionizing how we think about secure credit card processing within merchant services. Instead of exchanging actual Primary Account Numbers (PANs), networks generate unique tokens that stand in place of card data. This modern approach reduces the risk of data breaches and enables faster, smoother transactions. With major card brands pushing toward widespread token adoption, it’s time for merchants to fully embrace tokenized payments. This guide explains how network tokenization works, its key benefits, and how to integrate it into merchant services for stronger payment security.

What Is Network Tokenization?

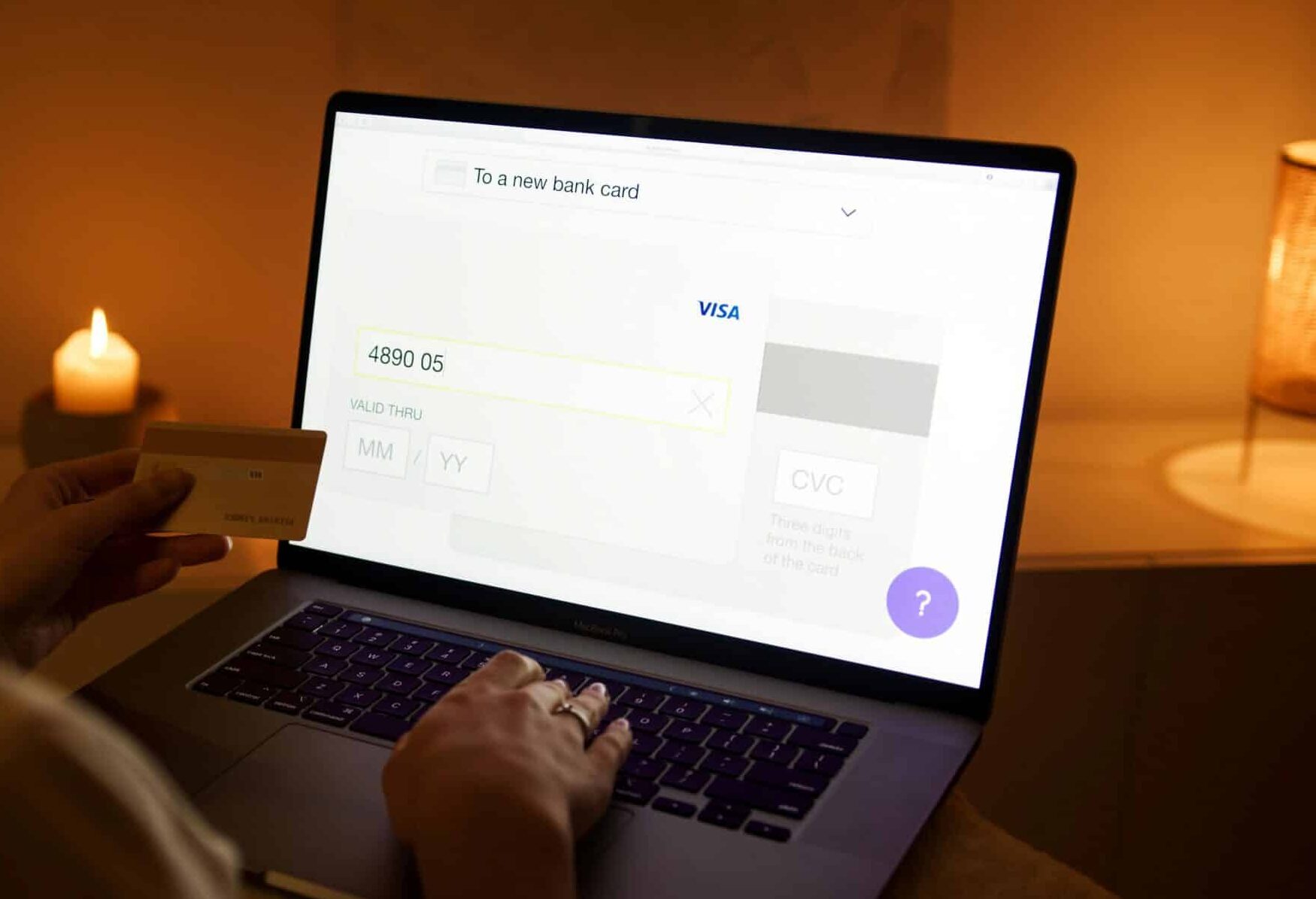

Network tokenization is a process where credit card numbers are replaced with secure, unique identifiers—or tokens—that are only meaningful within a specific payment environment. These tokens are generated and managed by the card networks (like Visa and Mastercard) instead of just by third-party providers. This means that even if a hacker intercepts the token, it’s useless outside the intended ecosystem. Tokenization is not new, but network tokenization takes the concept a step further by standardizing and authenticating tokens directly through card brands[1].

Benefits for Merchant Services

Network tokenization significantly strengthens merchant services by offering an added layer of data protection. Since tokens are stored instead of actual card numbers, businesses reduce their PCI scope and liability in case of a breach. It also enhances authorization rates because tokens are recognized and verified by the card networks themselves[2]. Merchants can store tokens for recurring billing, subscriptions, or one-click checkouts—all without compromising cardholder security. The overall effect is smoother processing and better customer trust.

Integrating Tokenized Payments Into Your Merchant Services

Businesses can integrate network tokenization into their systems through payment gateways or processors that support this technology. Choose a provider that offers native support for Visa, Mastercard, Amex, and other network-issued tokens. You’ll need to coordinate your ecommerce platform, CRM, and POS systems to ensure they support tokenized transactions. For businesses already using payment APIs, this usually means minimal code changes and better long-term protection[3]. Always check with your provider about how token lifecycle updates are handled to ensure smooth renewals and refunds.

How Tokenization Enhances Mobile and Contactless Payments

Network tokenization is the engine behind secure mobile payments and digital wallets. Apps like Apple Pay and Google Pay use tokenization to mask card numbers during tap-to-pay or online checkout. This adds another layer of protection on top of biometric authentication. For merchants, supporting tokenized mobile payments can increase sales from tech-savvy consumers. It also reduces fraud liability by shifting responsibility to the wallet provider or processor. In an era where mobile-first commerce is surging, tokenization is a smart investment. Additionally, as more consumers embrace contactless payment methods, the demand for secure tokenization solutions will only continue to grow.

Secure Credit Card Processing With Tokenized Payments

Reduced Fraud Risk

Tokenized payments dramatically lower the chances of card data theft. Because tokens are only valid within a specific merchant environment, stolen tokens cannot be reused elsewhere. This containment significantly weakens the value of stolen data in black markets. As a result, tokenization reduces both direct fraud incidents and the reputational damage that comes with them.

Improved Authorization Rates

Since network tokens are recognized by card brands, they typically deliver higher success rates during transactions. They help reduce false declines by maintaining updated card information, especially during reissues. Better authorization rates mean fewer lost sales and a better customer experience. This makes tokenization not just secure—but profitable.

Seamless User Experience

Tokenized payments support features like stored cards and one-click checkouts. Users get speed and convenience, while businesses retain customer loyalty. Since network tokens are updated automatically when cards expire or are replaced, customers won’t experience unnecessary interruptions. This frictionless flow improves conversions and supports repeat purchases.

PCI Scope Reduction

By using network tokens, merchants no longer need to store or transmit actual card numbers. This lowers their PCI DSS requirements and reduces compliance complexity. Less exposure means fewer security audits, less time spent on paperwork, and lower risk in general. Many merchants find that tokenization simplifies their entire compliance strategy.

Card Lifecycle Management

Network tokenization keeps token records updated even when cards are reissued due to expiration or loss. This minimizes payment disruptions and failed charges. It's especially beneficial for subscription-based businesses or those with stored credentials. Customers are less likely to churn due to billing errors, increasing long-term revenue retention.

Better Chargeback Defense

Since tokenized transactions are more secure and traceable, merchants have stronger evidence in chargeback disputes. They can demonstrate that the card was securely processed using verified tokens, which often tilts the decision in their favor. Less fraud also means fewer chargebacks to begin with, lowering operational costs and reputational risk.

Industries That Benefit Most From Tokenized Payments

Subscription Services

Recurring billing requires storing payment credentials securely. Tokenization allows companies to manage renewals without risking data leaks. It also ensures billing continuity even if a card is updated, minimizing customer churn.

Ecommerce Retailers

Online stores often experience the brunt of card-not-present fraud. Tokenized payments reduce this threat by rendering stolen tokens unusable. They also simplify compliance, making it easier to scale internationally.

Travel and Hospitality

These sectors rely on future-dated transactions and frequent card updates. Network tokenization helps prevent declined transactions and missed bookings due to outdated card info. It improves guest satisfaction and operational efficiency.

Healthcare and Telehealth

Patients need assurance their payment data is secure, especially when purchasing services online. Tokenization protects patient billing information while helping providers stay compliant with healthcare regulations.

Financial Services

From fintech apps to online lending platforms, financial businesses benefit from improved trust and reduced fraud exposure. Network tokens also help protect user data in multi-device ecosystems where risks are higher.

Gaming and Entertainment

In-app purchases and digital subscriptions require secure, seamless payment experiences. Tokenization ensures cards stay secure and minimizes disputes from unauthorized transactions. It also enhances UX for repeat customers.

Tokenization vs Encryption: What’s the Difference?

While both aim to protect sensitive data, tokenization and encryption operate differently. Encryption transforms card data into unreadable code using algorithms and keys. Tokenization replaces that data entirely with a token. Encryption can be decrypted if the key is compromised, while tokens have no intrinsic value if stolen. Both methods can coexist, and in fact, many systems use encryption during transmission and tokenization during storage. Understanding the difference helps merchants make better decisions about how to layer their defenses.

FAQ

Q: What is the difference between network tokenization and traditional tokenization?

A: Traditional tokenization is typically handled by a third-party payment processor, replacing card data with a token used only within that environment. Network tokenization, on the other hand, is managed directly by card networks like Visa and Mastercard. This allows tokens to be recognized across a broader ecosystem, increasing security and interoperability. Network tokenization also improves authorization rates and enables seamless card updates after reissuance.

Q: How does tokenization improve secure credit card processing?

A: Tokenization protects cardholder data by replacing the original card number with a meaningless token. These tokens cannot be reverse-engineered, even if intercepted. This reduces fraud, improves compliance with PCI DSS standards, and lowers the overall risk to your business[4]. As a result, secure credit card processing becomes easier and more scalable.

Q: Can tokenization be used with stored payment information?

A: Yes, one of the main advantages of tokenization is the ability to securely store payment credentials for repeat customers or subscription billing. Network tokens remain valid even if a card is reissued, ensuring continuity. This reduces failed transactions and improves customer satisfaction over time.

Q: Does tokenization help reduce chargebacks?

A: Tokenized transactions are harder to exploit, which leads to fewer fraudulent chargebacks. In legitimate disputes, tokenization provides a digital paper trail that supports your case. This can result in more favorable resolutions and lower dispute rates overall. It also reduces unnecessary fees and resource strain from chargeback management.

Q: Is tokenization required for PCI compliance?

A: While not mandatory, tokenization is strongly recommended for businesses seeking to reduce their PCI scope. By eliminating the need to store raw card data, it simplifies compliance and lowers audit requirements. Many payment providers offer tokenization tools as part of their PCI compliance strategy.

Q: How do I start using network tokenization in my business?

A: First, work with a payment processor or gateway that supports network-issued tokens. Ensure your ecommerce platform and systems are compatible. You may need to make minor technical changes, such as updating API calls or checkout flows[5]. Many providers offer developer support and onboarding to help you implement tokenization correctly.

Final Thoughts

In the fast-evolving world of e-commerce and digital payments, network tokenization is one of the most effective strategies for secure credit card processing. It strengthens merchant services by reducing fraud, improving authorization rates, and making PCI compliance more manageable. Whether you run a subscription service, an online store, or a mobile app, tokenized payments can future-proof your checkout experience. For expert guidance and support, Payment Nerds helps businesses of all types implement secure and scalable payment solutions built on network tokenization.

Sources

- Visa. “Network Tokenization: A Guide for Merchants.” Accessed June 2025.

- Mastercard. “Understanding Tokenization.” Accessed June 2025.

- Forrester. “The Future of Payments Security.” Accessed June 2025.

- PCI Security Standards Council. “PCI DSS Quick Reference Guide.” Accessed June 2025.

- Netskope. “Tokenization vs. Encryption.” Accessed June 2025.