In today’s fast-paced retail environment, your point-of-sale (POS) system serves as the central nervous system of your business operations. From processing transactions to tracking inventory, these systems have evolved dramatically over the years, with many businesses now facing a crucial decision: stick with a traditional POS setup or transition to an online POS platform. This choice isn’t merely about keeping up with technology—it’s about finding the right tools that align with your business goals, customer expectations, and operational needs. If you’re noticing slowdowns in checkout processes or limitations in reporting capabilities, these might be signs you need to modernize your POS system to remain competitive[1].

The shift toward digital solutions has made online POS systems increasingly attractive, offering cloud-based functionality, remote management capabilities, and streamlined payment gateway setup processes. But is this transition right for every business? Before you consider an online POS system, it’s essential to understand the fundamental differences between traditional and cloud-based options, including their respective strengths, limitations, and total cost of ownership. The right choice ultimately depends on your specific business requirements, technical comfort level, and long-term strategic vision—factors we’ll explore thoroughly in this comprehensive comparison.

What is a Traditional POS System?

A traditional POS system typically consists of fixed hardware elements—including a cash register, barcode scanner, receipt printer, and card reader—all connected to a locally-installed software program running on a dedicated computer terminal. These systems have been the backbone of retail and restaurant transactions for decades, operating as self-contained units that process sales, track inventory, and manage customer data without requiring constant internet connectivity. The software runs locally on the terminal, with data stored on-premise rather than in the cloud, providing businesses with direct control over their transaction information and reducing vulnerability to internet outages. Traditional POS systems often require more substantial upfront investment but have historically offered reliability and stability that many established businesses value.

Despite the rise of cloud-based alternatives, traditional POS systems remain a significant segment of the market, with the overall POS market size expected to grow almost 20% through 2030[2]. This continued growth reflects the enduring advantages these systems offer for certain business models, particularly those in areas with unreliable internet connectivity or industries with specific compliance requirements. Traditional systems have also evolved in response to market demands, with many now offering hybrid capabilities that combine local operation with some cloud-based features. For businesses with high-volume transactions or specialized needs, these systems continue to provide robust solutions that balance proven reliability with incremental technological advancement.

Online POS Systems and Multi-Location Management

Businesses with multiple retail locations, pop-up shops, or online storefronts need advanced POS systems to manage inventory, sales, and reports effectively. Online POS solutions excel by centralizing data in real time, allowing owners to monitor sales, employee performance, and stock levels from one dashboard. This automation streamlines reporting, simplifies promotional rollouts, and ensures consistent pricing and discounts across all locations. For companies planning to scale, starting with an online POS helps avoid the challenges of disconnected systems often found in traditional POS setups, which can slow down reporting and lead to inconsistencies. Many businesses choose online POS solutions to future-proof their operations and maintain brand consistency.

Security Considerations: Online POS vs Traditional POS

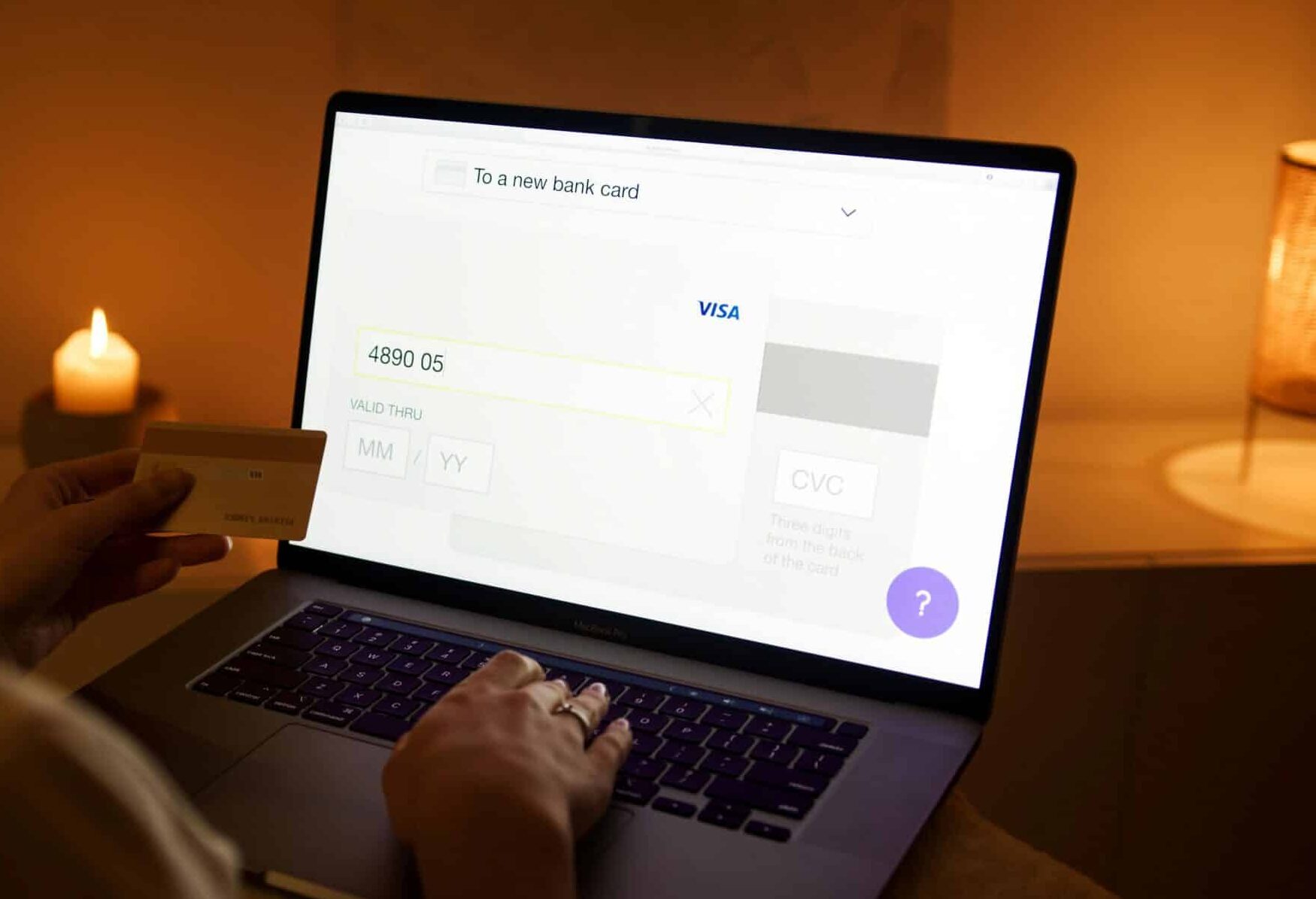

Security is a major concern for businesses processing customer payments, whether through traditional card readers or mobile apps. Traditional POS systems store transaction data locally, reducing exposure to internet attacks but increasing risks if hardware is stolen. Maintaining PCI compliance can also be complex and costly. In contrast, online POS systems utilize cloud servers with enterprise-grade encryption, automatic backups, and centralized compliance management. These providers undergo regular audits to meet PCI DSS standards, enhancing protection against threats. However, businesses must still secure local networks with strong passwords, VPNs, and software updates. Choosing between traditional and online POS involves considering transaction speed, convenience, and long-term data protection strategies.

Customization and Integration Capabilities

Modern businesses rely on integrated workflows between their POS systems, accounting software, loyalty programs, eCommerce platforms, and inventory management tools. Online POS systems are more flexible due to open APIs and app marketplaces, allowing for easy customization of sales processes and inventory management. In contrast, traditional POS systems often require costly custom programming for integration, locking companies into specific vendors and necessitating manual data transfers. Online POS platforms empower businesses to create interconnected tech stacks that enhance operational efficiency and customer engagement, crucial for industries like fashion, electronics, and hospitality where quick adaptation offers a competitive edge.

Operational Costs Beyond the Initial Investment

Cost comparisons between traditional and online POS systems should consider more than just initial hardware or subscription fees. Traditional systems require significant upfront investments in equipment and licensed software, with ongoing costs for repairs and updates. While online POS solutions often include software, support, and security in predictable subscription fees, businesses should also be aware of potential extra charges for features like analytics and loyalty programs. Additionally, internet redundancy, like cellular backup plans, may be necessary for online systems. Decision-makers should analyze total costs over three to five years to make well-informed comparisons based on their operational needs.

Key Differences

Internet Dependency

Traditional POS systems operate independently, functioning even during internet outages since they store data locally. Online POS systems require consistent internet connectivity to process transactions and sync data, though many offer limited offline modes for basic functions during connectivity interruptions.

Cost Structure

Traditional POS systems typically involve higher upfront costs for proprietary hardware and software licenses but may have lower long-term expenses. Online POS solutions generally feature lower initial investment with predictable monthly subscription fees, making them more accessible for businesses with limited capital.

Accessibility and Mobility

Traditional POS systems are generally fixed to specific locations, requiring staff to complete transactions at designated terminals. Online POS systems enable transactions from multiple devices anywhere with internet connectivity, allowing for tableside ordering in restaurants or line-busting during busy retail periods.

Updates and Maintenance

Traditional POS systems require manual updates, often scheduled during off-hours or requiring technician visits to implement new features or security patches. Cloud-based POS solutions automatically update in the background, continuously delivering new features, security improvements, and bug fixes without disrupting business operations.

Conclusion

The cloud-based nature of online POS systems creates a centralized data environment where inventory, sales, and customer information synchronize in real-time across all connected devices and locations. This architecture enables business owners to access comprehensive analytics dashboards from anywhere, monitor multiple stores simultaneously, and implement changes to product offerings, pricing, or promotions with immediate effect across all sales channels. Most online POS providers operate on subscription-based models, charging monthly or annual fees that typically include software updates, security patches, and technical support—creating predictable operational expenses rather than large capital outlays[3]. This combination of mobility, real-time data access, and reduced upfront costs has made online POS systems increasingly popular among new businesses and those transitioning from older technology.

Selecting the right POS system represents one of the most consequential technology decisions a business owner will make—one that impacts everything from daily operations to long-term growth potential. Modern POS systems bring order to chaos by transforming disconnected processes into streamlined workflows, whether through the proven reliability of traditional setups or the flexibility of cloud-based alternatives[4]. The ideal choice ultimately depends on your specific business model, growth trajectory, and operational preferences. Businesses with stable locations, specialized hardware needs, or concerns about internet reliability may find traditional systems provide the consistency they require, while companies prioritizing mobility, real-time data access, and minimal upfront investment often thrive with online solutions.

For businesses still weighing their options, consulting with experienced providers like Payment Nerds can provide valuable insights tailored to your specific industry and scale. Payment Nerds offers both online and traditional POS systems, allowing business owners to compare features, costs, and implementation processes directly before making a commitment. Remember that your POS system should adapt to your business needs rather than forcing your operations to conform to technological limitations. By thoroughly evaluating your transaction volume, growth plans, and staff capabilities, you can select a solution that not only meets today’s requirements but positions your business for success as consumer expectations and payment technologies continue to evolve.

Sources

- POSNation. "Cloud-Based POS vs. Traditional POS: How to Make the Right Choice." Accessed March 16, 2025.

- MobiDev. "POS Technology Trends 2025." Accessed March 16, 2025.

- Javelin. "2025 Small-Business Point-of-Sale System Scorecard." Accessed March 16, 2025.

- HFTP. "Top 10 Reasons to Replace Your POS System in 2025." Accessed March 16, 2025.