As digital commerce continues to evolve, pay-by-link email solutions have emerged as a powerful tool for high-risk merchants seeking flexible, customer-friendly ways to collect payments. These links enable businesses to send a secure, one-time payment URL to customers via email, SMS, or messaging platforms—offering a seamless, card-not-present transaction without the need for a traditional checkout page. For companies operating in sensitive verticals like nutraceuticals, firearms, coaching programs, or subscription services, the convenience of pay-by-link features can help reduce abandonment, boost conversion rates, and streamline invoicing. But with flexibility comes risk. If not implemented correctly, pay-by-link workflows can expose businesses to fraud, chargebacks, or compliance issues—particularly for those with elevated reputational or regulatory profiles. By combining thoughtful setup with the right merchant services payment processing infrastructure, high-risk merchants can turn pay-by-link functionality into a secure and scalable revenue channel.

Why High-Risk Merchants Rely on Pay-by-Link Payment Tools

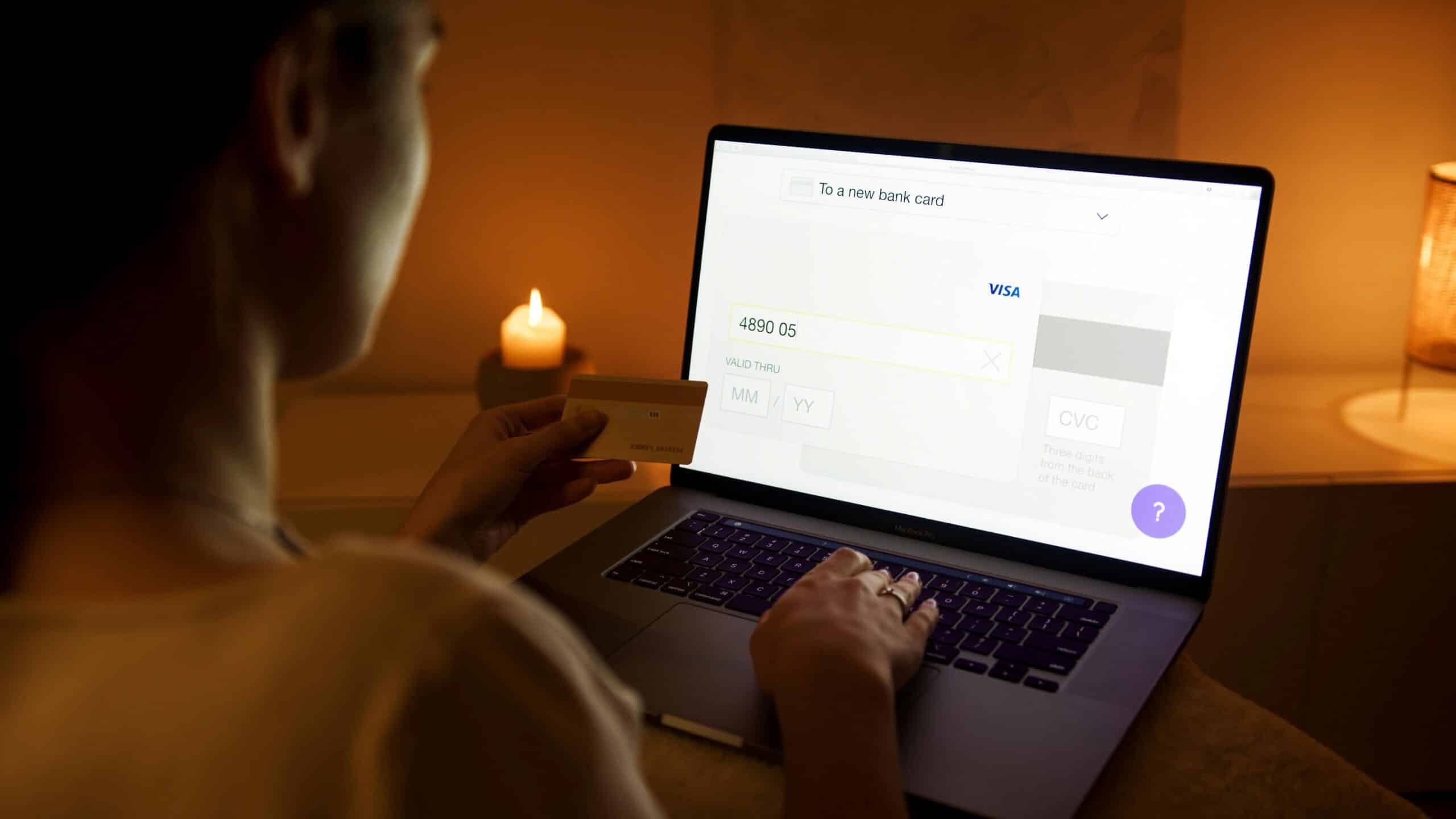

For many high-risk merchants, conventional payment portals come with friction points that discourage customer completion. Some businesses, especially those with mobile-first or sales-assisted models, may not have a full website checkout or may rely on remote invoices. In these cases, pay-by-link functionality offers an elegant solution that allows payment to happen wherever the customer is—without a cumbersome registration process or on-site form. These links can be embedded in emails, invoices, or messages, creating a highly personalized and timely call to action. Whether you’re collecting a balance after a phone consultation or billing for a recurring shipment, a secure payment link makes the experience fast and intuitive. More importantly, when integrated with a PCI-compliant merchant account card processing solution, these links can be tokenized and encrypted, protecting customer data while ensuring a smooth transaction flow[1]. For merchants in high-risk categories, where declined transactions and customer hesitancy are more common, pay-by-link provides a streamlined alternative that can significantly increase collection rates.

The Security Risks of Pay-by-Link—and How to Mitigate Them

While pay-by-link systems provide ease of use, they also introduce new attack surfaces for cybercriminals and fraudsters. Since these links often bypass typical website fraud filters or customer verification flows, they can be exploited if not properly secured[2]. Fraudsters may intercept links, manipulate expiration times, or use bots to test stolen card numbers through open payment forms. For high-risk merchants already under closer scrutiny from card networks and processors, this exposure can trigger account freezes or a spike in chargeback ratios. The solution lies in working with a merchant processing service that supports link-specific controls—such as IP logging, tokenization, real-time fraud scoring, and link expiration logic. Links should never be open indefinitely and should be tied to a specific customer record or invoice[3]. Additionally, businesses must ensure that links are only sent to verified communication channels and are not indexed or publicly accessible. When properly configured, secure pay-by-link setups can match or exceed the protection of traditional online checkouts while offering unmatched flexibility.

Tokenized Payment Data

High-risk merchants must use merchant processing services that tokenize sensitive payment details before submission. This reduces PCI scope and protects cardholder data even if a link is compromised.

Custom Link Expiration and One-Time Use Controls

Links should automatically expire after a defined time window or after one successful transaction. This helps prevent unauthorized re-use and limits the risk of fraudulent activity.

Real-Time Fraud Scoring

A reliable merchant processing service will apply real-time fraud scoring models to pay-by-link transactions, flagging abnormal patterns based on geolocation, IP address, and transaction velocity.

Branded and SSL-Secured Payment Pages

Each link should lead to a secure, branded page that clearly identifies the merchant, includes HTTPS encryption, and instills trust in the end user before they enter payment information.

How to Stay Compliant While Using Pay-by-Link in High-Risk Verticals

Compliance is a critical concern for merchants sending payment links in industries already flagged as high-risk. In 2025, credit card processing service providers are enforcing stricter PCI DSS v4.0 standards, which mandate transparent opt-in processes, secure data capture, and authenticated access to payment tools. This means that your pay-by-link setup must align with updated encryption standards, offer clear refund policies, and avoid misleading or vague product descriptors on the checkout page. For example, in verticals like supplements or coaching services, vague language about “transformation packages” or “wellness resets” can trigger red flags with processors. Use clear product names, itemized pricing, and visible business contact details on each pay-by-link page. Make sure all links are issued through a system that tracks usage, timestamps delivery, and stores proof of customer interaction in case of disputes[4]. These steps reduce risk while increasing the likelihood of approval from your merchant processing services provider.

Optimizing Customer Experience with Pay-by-Link Workflows

While fraud prevention and compliance are essential, customer experience still defines the success of pay-by-link workflows. The most effective implementations minimize steps, remove friction, and clearly communicate what the customer is paying for. Page load times, mobile responsiveness, and visual branding all contribute to conversion rates, especially in high-risk verticals where customer skepticism can be higher. When integrated with CRM systems and automated email workflows, pay-by-link solutions enable seamless follow-ups, reminders, and confirmations—making the experience feel polished and professional. A well-crafted pay-by-link page reassures customers that they are transacting with a legitimate, secure business backed by a trusted merchant account card processing provider. Additional features like saved card options, email receipts, and loyalty tracking can further enhance the experience and increase repeat purchases. The key is finding a balance between flexibility, control, and trust—a formula that modern merchant services payment processing systems are designed to support.

Conclusion

Pay-by-link emails offer high-risk merchants a powerful, flexible tool for collecting payments in a fast, secure, and customer-centric way. But without the right controls in place, they can also expose businesses to increased fraud, compliance issues, and processor scrutiny[5]. That’s why it’s essential to partner with a merchant processing service that understands the specific needs and vulnerabilities of high-risk industries. At Payment Nerds, we help merchants deploy secure, PCI-compliant pay-by-link systems that improve cash flow while reducing chargeback exposure. Whether you’re invoicing clients in a regulated sector or offering subscription-based packages via email, we’ll help you implement payment tools that convert better, protect data, and align with the latest credit card processing service standards. With the right setup, pay-by-link doesn’t just simplify transactions—it becomes a competitive advantage.

Sources

- PCI Security Standards Council. “PCI DSS v4.0 Compliance for Payment Links.” Accessed April 2025.

- Forbes. “How Pay-by-Link Is Transforming Remote Payments.” Accessed April 2025.

- Federal Trade Commission. “Best Practices for Card-Not-Present Merchants.” Accessed April 2025.

- Harvard Business Review. “Reducing Friction in Payment Workflows.” Accessed April 2025.

- McKinsey & Company. “The Future of Flexible Payment Channels.” Accessed April 2025.