Chargebacks have become a major challenge for e-commerce businesses, leading to financial losses, strained relationships with payment processors, and reputational damage. In 2023 alone, global chargeback fraud cost businesses an estimated $117 billion in lost revenue and operational expenses[1]. As e-commerce continues to grow, so do the risks associated with fraudulent disputes and unwarranted chargebacks.

To remain competitive and profitable, online retailers must take proactive measures to prevent chargebacks, mitigate fraud risks, and ensure secure payment processes. This article explores the root causes of chargebacks, their impact on e-commerce businesses, and the most effective strategies for chargeback prevention, e-commerce fraud mitigation, and secure payments.

Understanding Chargebacks in E-Commerce

What Is a Chargeback?

A chargeback occurs when a customer disputes a transaction and requests a refund from their bank or credit card issuer rather than resolving the issue with the merchant. The issuing bank then investigates the dispute and, if deemed valid, forces the merchant to return the funds.

Chargebacks were originally designed as a consumer protection mechanism, but they have evolved into a significant challenge for online retailers due to increasing fraud and abuse.

Common Reasons for Chargebacks

Fraudulent Transactions (Friendly Fraud & True Fraud)

- Friendly fraud happens when a customer disputes a legitimate purchase, claiming they never received the product or didn’t authorize the transaction.

- True fraud occurs when stolen payment credentials are used to make a purchase.

Merchant Errors

- Incorrect product descriptions or misrepresented items.

- Shipping delays or failure to deliver goods.

- Unauthorized recurring charges.

Customer Dissatisfaction

- Product quality not meeting expectations.

- Lack of communication or customer support.

Subscription Cancellations & Recurring Billing Disputes

Many chargebacks stem from customers forgetting about subscriptions or failing to cancel before an automatic renewal.

1. Implementing Strong Fraud Prevention Measures

Fraud prevention tools can help e-commerce businesses detect and prevent fraudulent transactions before they escalate into chargebacks. Essential fraud prevention techniques include:

- AI-driven fraud detection to analyze transaction patterns and flag high-risk purchases[3].

- Multi-factor authentication (MFA) to add an extra layer of security for transactions.

- Address Verification System (AVS) to match the billing address with the cardholder’s records.

- Card Verification Value (CVV) checks to prevent unauthorized card usage.

2. Improving Product Descriptions & Transparency

Clear and accurate product descriptions can prevent misunderstandings that lead to chargebacks. Retailers should:

- Use detailed product images and videos to set realistic expectations.

- Provide accurate shipping times and communicate any potential delays.

- Disclose return and refund policies clearly on product pages and checkout screens.

3. Enhancing Customer Support & Dispute Resolution

Poor customer service is a common reason customers turn to chargebacks. Businesses should:

- Offer 24/7 live chat or email support to resolve customer issues promptly.

- Provide an easy-to-find refund and return policy to encourage disputes to be handled directly with the business rather than through banks.

- Use proactive order tracking updates to reduce “item not received” claims.

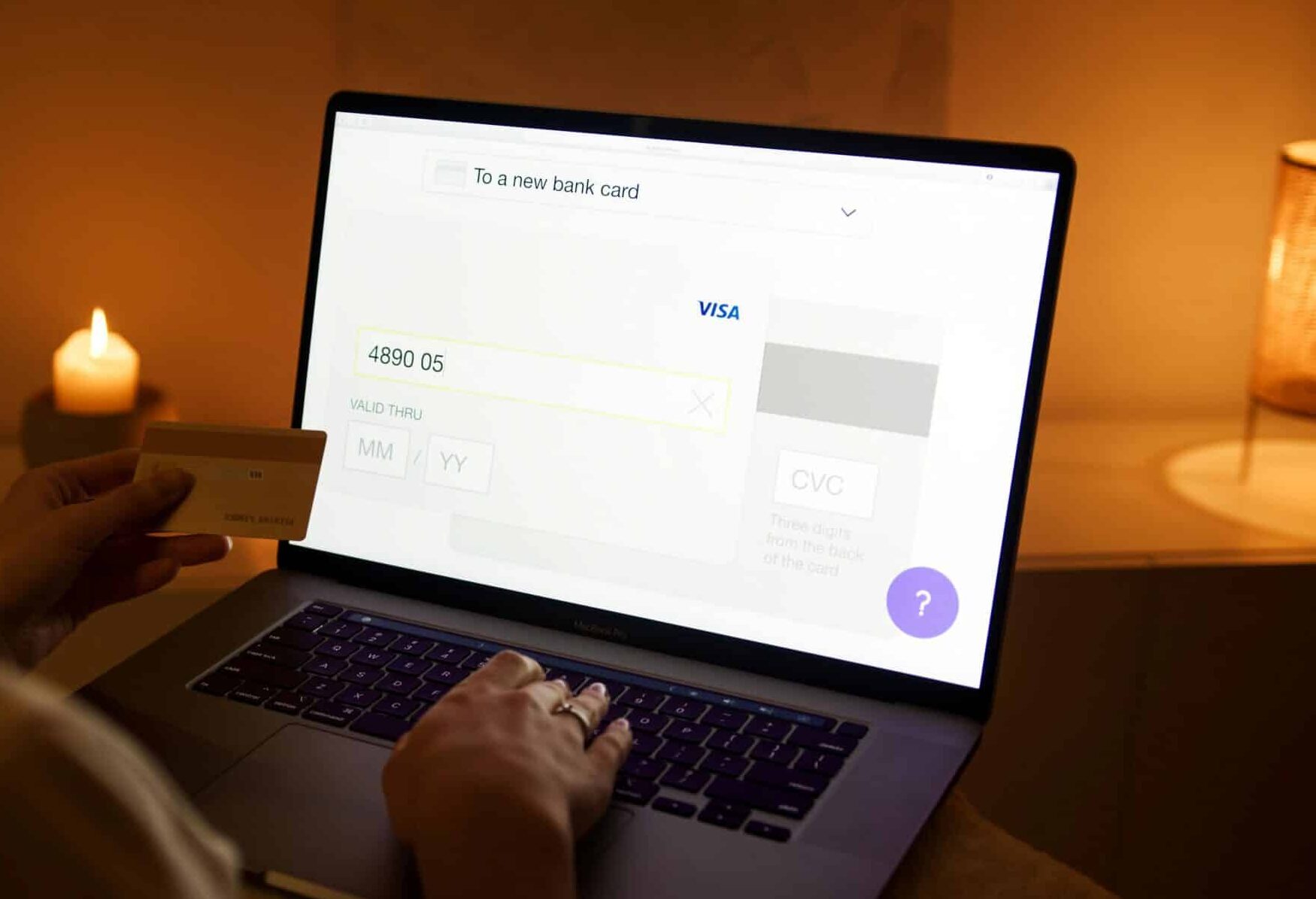

4. Strengthening Payment Security

Secure payment processing is crucial to reducing fraudulent chargebacks. Steps include:

- Tokenization to replace sensitive payment data with unique, encrypted tokens.

- PCI DSS compliance to ensure all payment data is processed securely[4].

- Secure payment gateways that detect high-risk transactions and block fraudulent payments before they occur.

5. Monitoring Chargeback Ratios

Payment processors closely monitor merchants’ chargeback-to-transaction ratio (CTR). The industry standard threshold is typically below 1%—exceeding this level can lead to penalties.

Merchants can track and analyze their chargeback ratio using chargeback management tools and work with payment processors that provide real-time alerts on potential disputes.

6. Utilizing Chargeback Alerts & Prevention Services

Chargeback prevention tools, such as Verifi and Ethoca, notify merchants about disputes before they escalate into full chargebacks[5]. These services allow businesses to proactively resolve disputes by offering refunds or clarifications before banks process chargebacks.

Case Study: How an E-Commerce Store Reduced Chargebacks by 40%

An e-commerce retailer specializing in subscription beauty products faced rising chargeback rates due to customer disputes. This surge increased operational costs from higher payment processor fees and strained relationships with processors. The chargeback increase could harm the retailer’s reputation, threaten profitability, and limit payment options. To address this, the retailer must reassess customer service policies, enhance fraud protections, and improve education on subscription services.

Challenges of Chargeback Prevention, Solutions, and Results

- Customers frequently forgot about auto-renewal charges, leading to disputes.

- Poor communication regarding return and refund policies.

- Fraudulent purchases from stolen credit cards.

Solutions Implemented:

- Improved subscription reminders and opt-in confirmations to ensure customer awareness.

- Integrated AI fraud detection software to identify suspicious transactions.

- Implemented chargeback alert services to intercept disputes early.

Results:

- 40% reduction in chargebacks within six months.

- Improved customer retention and fewer refund requests.

- Lower payment processing fees due to improved chargeback ratio.

The Future of Chargeback Prevention in E-Commerce

As e-commerce continues to evolve, new technologies are emerging to combat chargeback fraud:

- Blockchain for transaction security: Enhancing transparency and preventing fraudulent disputes[6].

- AI-driven chargeback risk scoring: Using predictive analytics to assess chargeback risk levels before transactions are approved.

- Biometric authentication in payments: Fingerprint and facial recognition for securing online transactions.

E-commerce merchants must continuously adapt to these technologies to stay ahead of fraudsters and reduce chargeback losses.

Conclusion

Chargebacks pose a serious risk to e-commerce businesses, but proactive prevention measures can significantly reduce financial losses. By implementing secure payment processing, fraud prevention tools, and chargeback dispute management solutions, businesses can protect their revenue and maintain positive relationships with payment processors.

As fraud tactics evolve, merchants must stay informed, invest in security technologies, and maintain excellent customer service to prevent disputes before they become costly chargebacks. For businesses seeking robust chargeback prevention solutions, working with a trusted payment processor like Payment Nerds can help minimize risk and ensure secure transactions.

Sources

- Juniper Research. eCommerce Losses to Online Payment Fraud to Exceed $48 Billion Globally in 2023. Accessed February 6, 2025.

- Chargebacks911. The Complete Chargeback Guide for Merchants & Consumers. Accessed February 6, 2025.

- Mastercard Services. Portfolio Intelligence Solutions. Accessed February 6, 2025.

- PCI Security Standards Council. Merchant Resources. Accessed February 6, 2025.

- Verifi. What are Chargeback Alert Defects/Errors and How Do They Occur?. Accessed February 6, 2025.

- Forbes. Beyond The Hype: How Blockchain Is Quietly Transforming Business. Accessed February 6, 2025.