Restaurants are embracing table-side payments as a way to provide better service and increase operational efficiency. No longer just a luxury, mobile payment systems have become an essential part of modern dining. Customers expect fast, convenient payment options that match the seamless service they experience throughout the meal. Merchant services now offer solutions tailored for hospitality, combining handheld POS systems, digital tipping, and real-time reporting. In this guide, we explore how restaurants can use merchant services to improve table-side transactions and overall service quality.

Why Table-Side Payments Matter in Restaurants

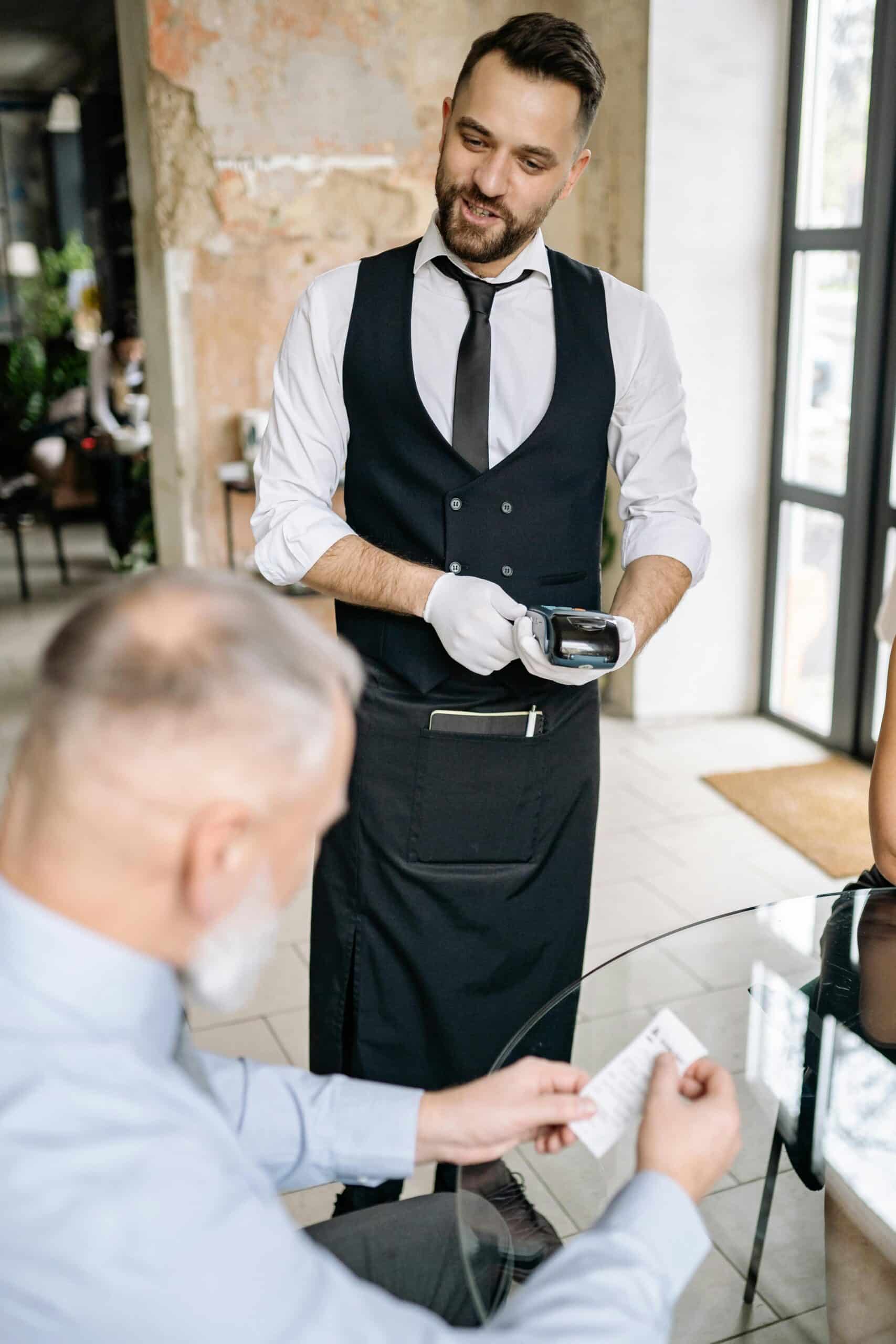

The traditional payment process—waiting for the check, handing over a card, and waiting again—creates unnecessary friction. With table-side payments, guests can complete transactions directly at their table, reducing wait times and increasing table turnover[1]. These solutions are especially valuable during peak hours when every minute counts. Modern merchant services for restaurants empower staff to take payments, split checks, apply discounts, and accept digital wallets without leaving the dining area. The result is faster payments, fewer errors, and better customer satisfaction.

Merchant Services Solutions Tailored for Table-Side Dining

The best merchant services offer devices and software built specifically for restaurant environments. Handheld POS terminals allow servers to take orders and accept payments from the same device[2]. These terminals support contactless payments, chip cards, and mobile wallets, all integrated with inventory and sales tracking tools. Digital tipping prompts and receipt options (email or text) add convenience while increasing tip amounts. Many merchant services also offer offline mode functionality, ensuring uninterrupted service even during internet outages[3].

Benefits of Modern Merchant Services for Restaurant Operations

Adopting new payment technologies delivers a range of operational benefits. First, it reduces errors in order-taking and bill calculation by minimizing manual input. Second, it decreases the likelihood of lost cards or declined transactions due to poor connectivity. Third, integrated systems allow owners and managers to monitor sales, tips, and staff performance in real time. With these tools in place, restaurants can reduce training time, improve service consistency, and adapt to customer preferences more effectively[4].

Customizing Payment Workflows for Better Service

Every restaurant is different, and so are their service workflows. A quick-service lunch spot might need speed above all, while a fine dining venue values discretion and accuracy. Merchant services can be configured for different service styles—whether it’s tableside ordering, pre-authorized tabs, or self-serve kiosks. Features like order modifications, loyalty program integration, and custom tip prompts can be toggled on or off depending on the concept. This flexibility allows restaurants to maintain brand identity while improving payment efficiency.

Integrating Payment Systems With Restaurant Software

To streamline back-office operations, payment systems must integrate with other restaurant software tools. This includes POS platforms, kitchen display systems, reservation apps, and accounting software. Merchant services providers that offer APIs or pre-built integrations make it easy to sync data across platforms. With centralized reporting and transaction history, restaurants gain better insight into customer behavior, peak service hours, and high-performing menu items. Integration simplifies tax reporting and payroll too, saving hours of manual reconciliation.

Challenges With Restaurant Table-Side Payments

Device Durability

Handheld POS devices must withstand spills, drops, and high-volume use. Choose providers that offer commercial-grade equipment with warranties and support.

Menu Complexity

Large menus with modifiers and combos can slow down table-side entry. Systems should offer intuitive item search and customizable layouts.

Connectivity Issues

Wi-Fi disruptions can halt payment processing. Offline modes and LTE-enabled devices provide backup.

Staff Training

Introducing new technology requires staff buy-in. Training programs and intuitive interfaces help ease the transition.

Data Security

Handling card data on mobile devices increases risk. Use PCI-compliant systems with point-to-point encryption.

High Upfront Costs

Investing in hardware and subscriptions can be costly. Look for providers that offer leasing options or bundled packages.

How Table-Side Payments Enhance Customer Experience

Speed, convenience, and transparency are the hallmarks of a great dining experience. With table-side payments, guests don’t need to wait for the check or worry about card mishandling. They can review their bill, tip appropriately, and pay using their preferred method—all from their seat. This empowers guests and builds trust. Restaurants that offer mobile payments often see higher satisfaction scores and repeat visits. By removing delays at the end of the meal, the last impression is as polished as the first. Speed, convenience, and transparency are the hallmarks of a great dining experience. With table-side payments, guests don’t need to wait for the check or worry about card mishandling. They can review their bill, tip appropriately, and pay using their preferred method—all from their seat. This empowers guests and builds trust. Restaurants that offer mobile payments often see higher satisfaction scores and repeat visits. By removing delays at the end of the meal, the last impression is as polished as the first. Additionally, streamlined payment processes can enhance staff efficiency, allowing servers to focus on providing excellent service. Ultimately, adopting innovative payment solutions can set a restaurant apart in a competitive market.

Building a Tech-Forward Hospitality Brand

Embracing modern merchant services signals to customers that your restaurant is tech-savvy and customer-focused. In competitive markets, this perception can be a key differentiator. Whether you’re a neighborhood bistro or a multi-location brand, offering table-side payments adds professionalism and convenience. It also positions your business to adopt future innovations like QR-code menus, dynamic pricing, or AI-powered guest recommendations[5].

FAQ

Q: What are merchant services for restaurants?

A: Merchant services for restaurants include payment processing systems, POS terminals, and software integrations designed to help restaurants accept and manage customer payments more efficiently.

Q: Are table-side payments secure?

A: Yes, when implemented with PCI-compliant hardware and encrypted payment solutions, table-side payments are highly secure. Look for providers that offer end-to-end encryption and tokenization.

Q: Do table-side payment systems support tips and check splitting?

Most modern systems do. These features are customizable, allowing servers to split checks, suggest tip amounts, and process group payments with ease.

Q: How much do table-side payment systems cost?

A: Costs vary based on hardware, software, and subscription models. Some providers offer leasing options or bundled deals to reduce upfront investment.

Q: Can I integrate table-side payments with my existing POS?

A: Many merchant service providers offer integrations or APIs that sync with popular POS systems. Always check compatibility before committing to new hardware.

Q: What are the benefits of using merchant services for table-side payments?

A: Benefits include faster checkout times, reduced order errors, improved customer satisfaction, and streamlined reporting and analytics for restaurant management.

Final Thoughts

Table-side payments are more than a trend—they’re a competitive necessity in modern hospitality. By implementing tailored merchant services for restaurants, business owners can improve service speed, reduce friction, and gain operational insight. At Payment Nerds, we help restaurants evaluate and integrate the right payment solutions to enhance guest satisfaction and drive profitability. Whether you’re upgrading your POS system or launching a new concept, smart payment tools will keep your service flowing smoothly.

Sources

- National Restaurant Association. "2025 State of the Restaurant Industry Report." Accessed June 2025.

- Square. "Mobile POS Solutions for Restaurants." Accessed June 2025.

- Toast. "Why Table-Side Ordering Matters." Accessed June 2025.

- Hospitality Technology. "How Mobile Payments Improve Guest Experience." Accessed June 2025.

- Forbes. "Trends in Restaurant Tech." Accessed June 2025.