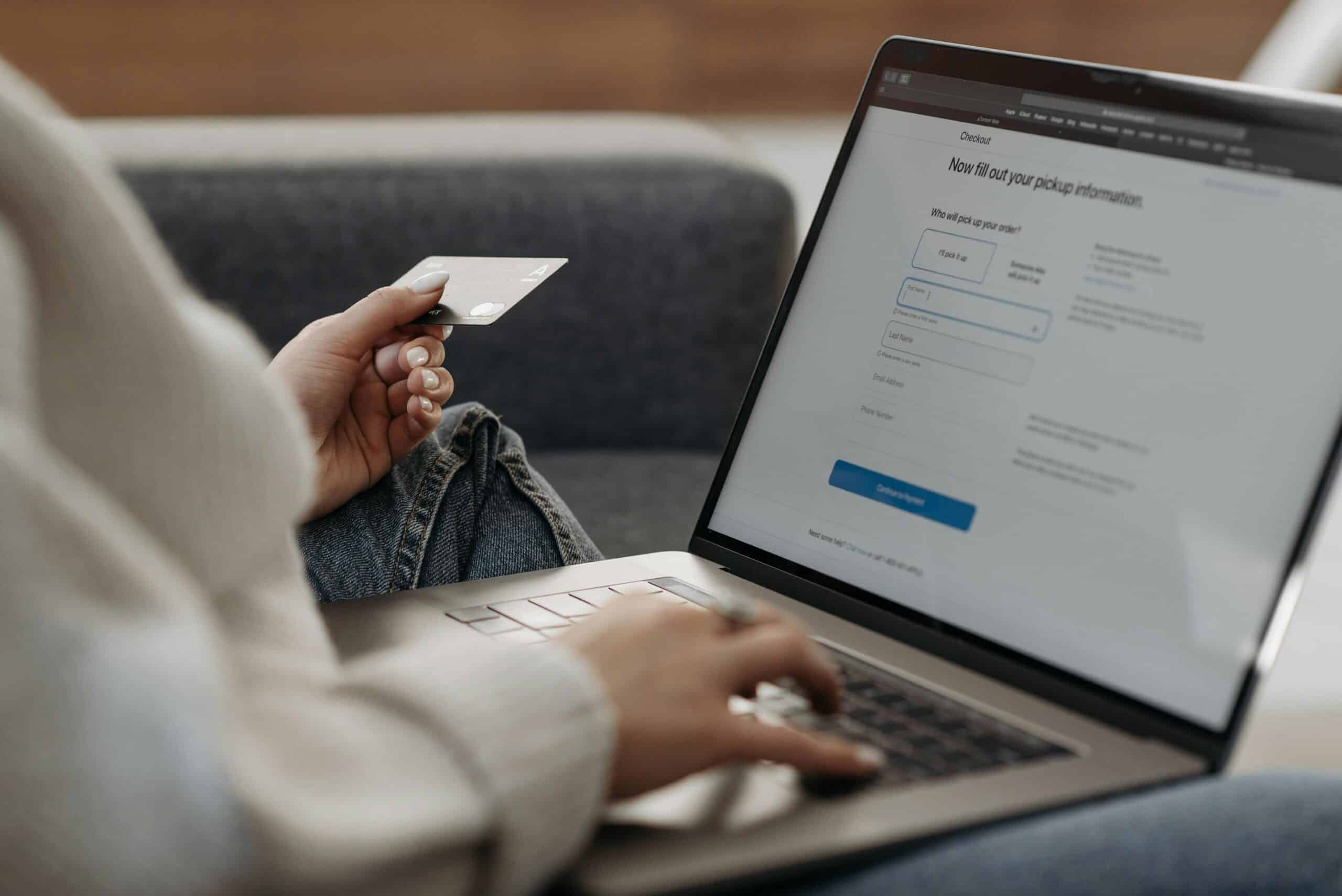

Migrating to a new merchant services provider can feel risky, especially when customer data and transaction history are involved. However, switching to a more reliable or affordable provider doesn’t have to mean losing vital payment information. If you use a credit card POS system or manage multiple payment methods, a well-planned migration can safeguard your data, minimize disruptions, and unlock better functionality. The key is to understand what data you can move, how to protect it, and what steps to take for a secure and seamless transition.

Why Businesses Migrate Payment Providers

There are many reasons companies outgrow their current merchant services provider. High fees, limited support, outdated POS payment systems, or security vulnerabilities often drive the change. In fast-moving industries like retail or hospitality, your payment system needs to evolve with customer expectations. Some businesses want more customization or integration with ecommerce platforms. Others are seeking better fraud tools or more transparent pricing. Whatever your motivation, understanding your goals makes it easier to choose a replacement that aligns with your long-term growth strategy[1].

What Data Can Be Migrated Securely

When transitioning payment providers, it’s important to understand what data can be legally and technically migrated. This includes customer contact information, billing histories, tokenized payment credentials (if available), and transaction records. Tokenized payments are easier to move than raw cardholder data, which may not be transferable due to PCI compliance. Some systems allow export of recurring billing agreements, loyalty program data, and POS sales reports[2]. Knowing your data landscape in advance helps set realistic migration goals and avoid costly surprises.

Preparing Your Team for a POS Payment System Change

Before making the switch, communicate with all stakeholders—cashiers, finance staff, IT teams, and customer service reps. Everyone should understand why the change is happening and how it impacts their responsibilities. Training sessions should be scheduled in advance, especially if the new system has a different interface or new workflows. Role-based permissions and access levels should be reviewed to match your internal security policy[3]. A smooth migration requires not just the right technology, but also staff buy-in and confidence in the new system.

FAQ

Q: What is the safest way to migrate a POS payment system?

A: The safest method is to create encrypted backups, use tokenized data, and run both systems in parallel during testing. This lets you verify functionality while retaining full access to historical data. Involve your IT team, confirm compatibility with hardware and software, and keep staff trained throughout the process.

Q: Can I transfer recurring billing accounts to a new provider?

A: Yes, but it depends on whether your current provider uses tokenized data that can be exported. Some providers allow seamless migration of payment tokens, while others require customers to re-enter billing details. Always verify this early in the process to avoid disrupting subscriptions.

Q: How long does it take to migrate a merchant services provider?

A: Migration time varies depending on business size and complexity. A small business may complete the switch in a few days, while larger operations might need several weeks. Planning ahead, documenting processes, and coordinating with both providers shortens this timeline significantly.

Q: What should I look for in a new credit card POS system?

A: Look for systems with tokenization, multi-channel compatibility, real-time reporting, and built-in fraud tools. The system should integrate with your ecommerce platform and support both in-person and online payments. Ease of use and strong customer support are also essential.

Q: Do I need to re-train employees after migrating?

A: Most likely, yes. Even small changes to interface or workflows can affect operations. Schedule training sessions ahead of launch to familiarize staff with the new system. This helps reduce errors, improves adoption, and ensures customer service remains strong during the transition.

Q: Is there a risk of data loss during provider migration?

A: There is always a risk, but you can minimize it with thorough backups, testing, and documentation. Avoid rushing the process. Validate each phase of migration, from sandbox testing to final rollout. This ensures data integrity and reduces disruptions.

How to Migrate Data Without Losing Customer Info

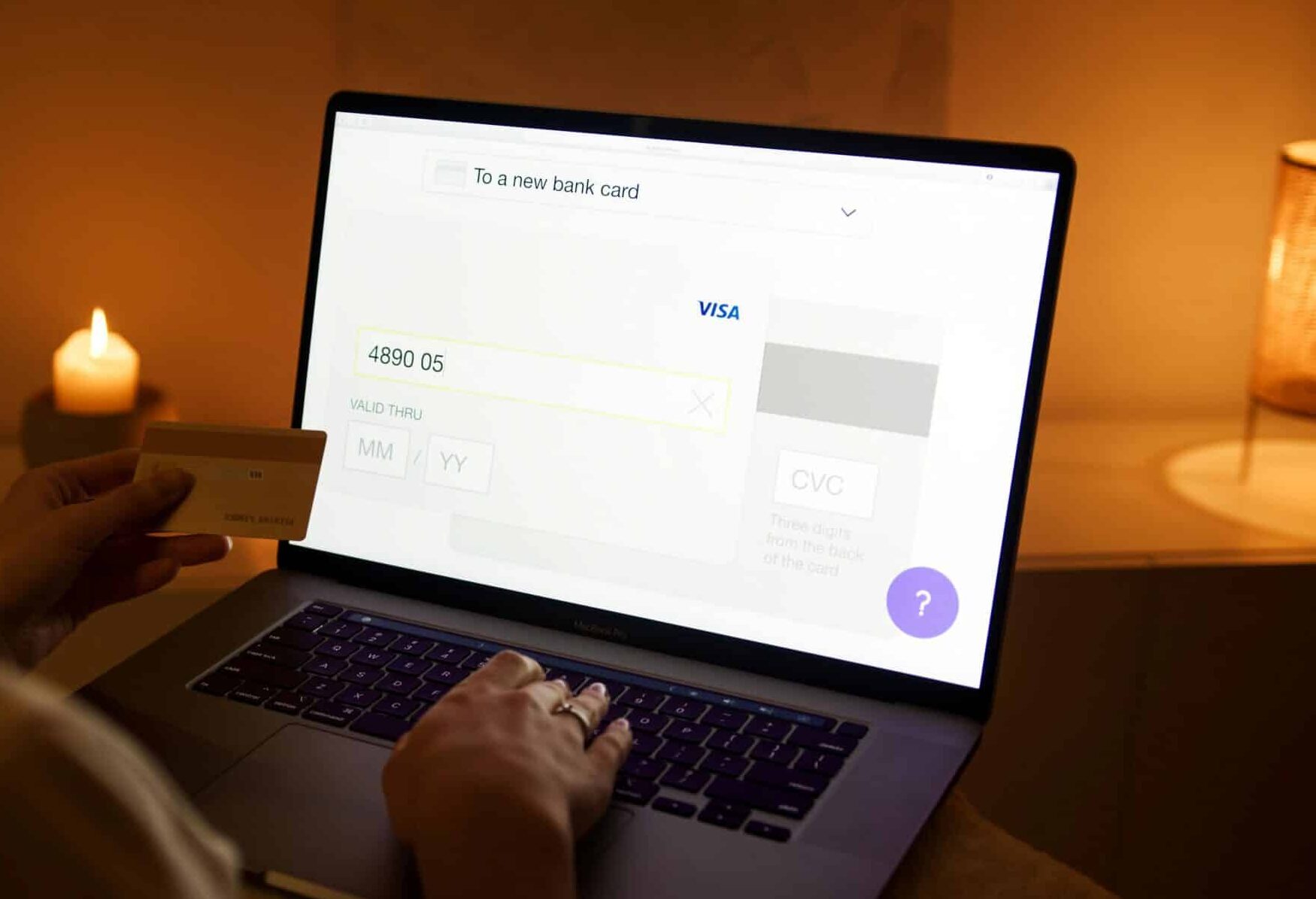

Use tokenized payment data

Tokenization replaces sensitive card data with a unique identifier. If your current merchant services provider offers tokenized payments, you may be able to port these tokens to the new provider. This allows you to maintain recurring billing and customer profiles without storing card numbers. Before switching, verify if your new provider accepts imported tokens and supports backward compatibility with existing systems.

Perform a full system backup

Create complete backups of your POS data, customer lists, and transaction histories before initiating the migration. These backups should be encrypted and stored securely in case of failure during transfer. Keep copies both onsite and in secure cloud storage. Having this backup ensures you can recover quickly if anything goes wrong during the switchover.

Involve your IT team early

Bring IT into the conversation during the evaluation and planning phase. They can help assess compatibility with your ecommerce platforms, POS hardware, and network infrastructure. Your IT team can also identify technical gaps, assist in API integration, and monitor for security issues during the transition. Their involvement helps prevent surprises that could delay or derail your timeline.

Notify recurring billing customers

If you run subscriptions or memberships, notify customers about the transition in advance. Let them know what to expect and whether they need to reauthorize payments. Some systems allow silent migration of tokens, while others may require user input. Being proactive with communication builds trust and reduces chargeback risk.

Audit for compliance risks

Any migration involving financial data must maintain PCI DSS compliance. Work with your new provider to ensure their platform meets all security standards. Conduct a gap analysis to identify where your setup may be vulnerable. This includes evaluating access controls, encryption protocols, and secure login processes.

Run parallel systems temporarily

Consider running both the old and new systems in parallel during the transition. This allows you to compare transaction logs, test real-time performance, and verify data integrity. Use this window to confirm that all payment methods—ACH, card, mobile, and more—are functioning properly. Once verified, you can confidently deactivate the old system.

Migrating an Ecommerce MLM Business

Managing complex payment structures

Ecommerce MLM businesses often use custom commission structures and automated payouts. When switching merchant services, ensure your new provider supports split payments or multi-user accounts. This functionality is critical for maintaining downline payment automation.

Transferring subscription billing

Many MLMs rely on auto-ships and monthly billing. Token migration or customer reauthorization may be required. Choose a provider that offers assistance with recurring billing migration to reduce churn.

Verifying product and service codes

MLM product types can trigger flags with new providers. Confirm that your MCC (merchant category code) is accepted and that your products meet underwriting standards. Misalignment here can cause account holds or denials.

Avoiding processing delays

During migration, ensure your old provider doesn’t freeze payouts or delay settlements. Request final reports and confirm cutoff dates. Overlapping periods should be accounted for in your financial forecasting.

Re-onboarding affiliates

If your system integrates with an affiliate portal, ensure that login credentials, dashboards, and payout histories remain intact. Communicate clearly with your network to prevent confusion or trust erosion.

Maintaining compliance with policies

MLM and ecommerce businesses face strict scrutiny. Review your terms of service, privacy policy, and chargeback procedures to align with your new provider’s expectations. This prevents friction during onboarding or audit events.

Common Pitfalls When Migrating Merchant Services

Failing to confirm data portability is a frequent misstep. Not all payment data—especially encrypted or raw cardholder details—can legally be transferred. Some providers may even withhold data to prevent churn. Another issue is overlooking hardware compatibility when moving to a new POS payment system. Some terminals may not support the same processors, especially if your new provider uses proprietary tech[4]. Avoid downtimes by asking about migration support and whether they offer temporary dual integrations or sandbox testing environments.

Choosing a Future-Ready Merchant Services Provider

When selecting your next provider, prioritize those that offer flexible integrations, responsive support, and transparent pricing. Look for credit card POS systems that scale with your needs—whether you’re expanding to new locations or launching ecommerce functionality. Ask if they offer sandbox environments for testing and how they handle PCI compliance. Providers that support tokenized payments and multi-channel reporting will make your next migration even easier[5]. Don’t be afraid to negotiate terms or ask about transition support as part of the onboarding.

Final Thoughts

Changing your merchant services provider doesn’t have to mean starting over. With the right strategy, businesses can retain valuable customer and transaction data while upgrading to a faster, safer, and more cost-effective solution. Whether you’re replacing a credit card POS system or overhauling your ecommerce platform, planning and communication are essential. Tokenization, parallel testing, and compliance audits should be part of every migration checklist. By working with a provider like PaymentNerds that understands your industry, you’ll not only preserve your data—you’ll future-proof your payments and build a foundation for growth.

Sources

- Square. “How to Change Your POS System.” Accessed June 2025.

- Visa. “Tokenization Best Practices.” Accessed June 2025.

- PCI Security Standards Council. “Understanding PCI DSS Compliance.” Accessed June 2025.

- NCR. “Preparing for a Payment System Transition.” Accessed June 2025.

- Bankrate. “What to Know Before Changing Payment Providers.” Accessed June 2025.