With an increase in the availability of e-commerce, millions of companies conduct e-commerce transactions every day. While payment processing might be second nature for more stable companies, high-risk merchants find the path from cart to checkout to settlement complicated. That’s why any high-risk merchant must understand what an e-commerce transaction is and how the payment flow process works. Once merchants are in the know, a high-risk merchant account provider can protect them from fraud, reduce chargeback rates, and ensure customers have seamless payment.

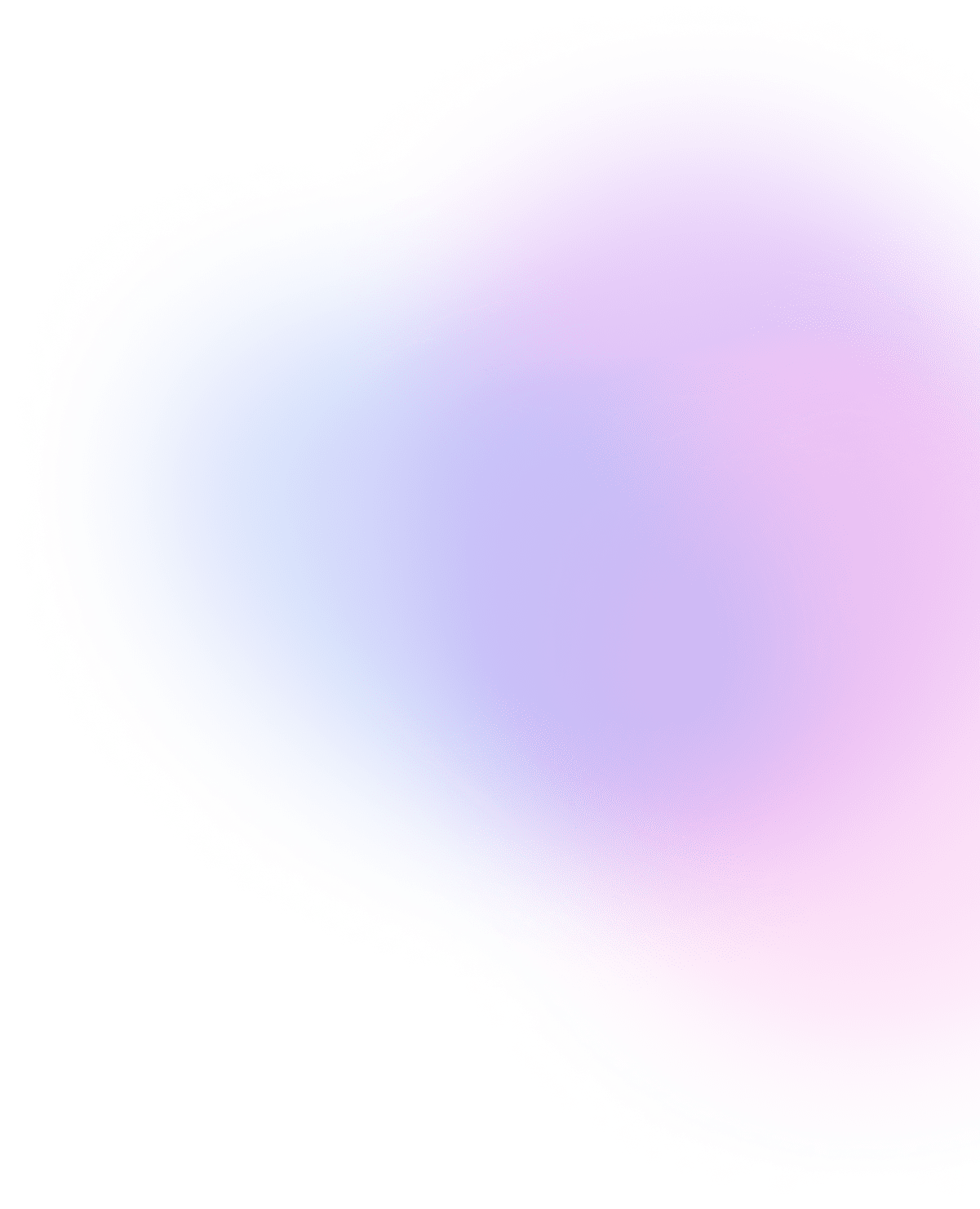

What Are Ecommerce Transactions?

E-commerce transactions are financial transactions processed over the internet for goods or services purchased online that rely on an online credit processor to make payments. This credit processor could be a credit card, debit card, ACH transfer, or even a mobile wallet, which is more popular today. In any case, after an e-commerce transaction takes place, a banking institution must authorize it, then the seller must get payment through a credit processor, followed by the official merchant making the sale to ensure all parties (and all fees) get paid. For regulated/high-risk industries, this adds another level of scrutiny as there are elements of some businesses that might allow for fraudulent (or non-fraudulent) activity, regulatory nuances, or increased chargeback risk. Understanding how e-commerce payments flow through the system can better prepare merchants to protect their revenue.

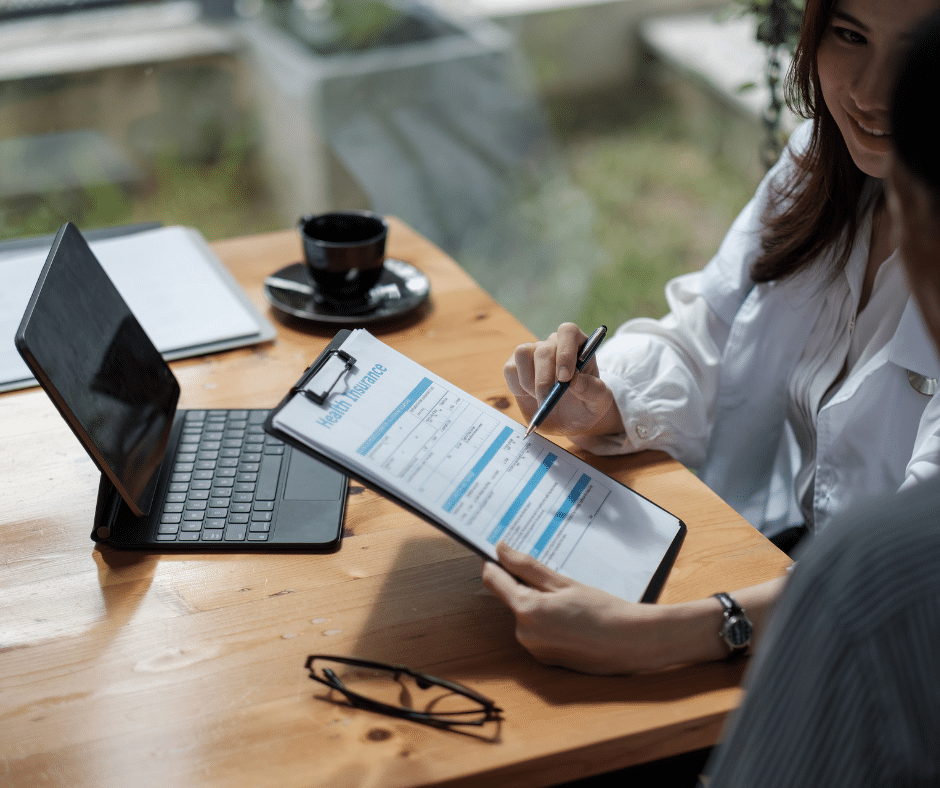

Where High Risk Differs

In many ways, high-risk ecommerce transactions are not different from ‘normal’ ecommerce transactions. However, it’s the players involved and what encourages or discourages certain behaviors that make the payment flow different. CBD-related companies, vitamin supplement merchants, firearms merchants (and many more), and the travel industries have much higher exposure to fraud and regulations that can make them more vulnerable to chargebacks[1]. Working with a high-risk merchant account provider is how these types of companies can get payment processing where other banking institutions or merchant service providers will not. Without such accounts, companies will have frozen funds, terminated accounts and an inability to accept payments at all. Therefore, working with a high-risk acquirer makes the process easier but also grants access to industry-specific tools that encourage fraud protection.

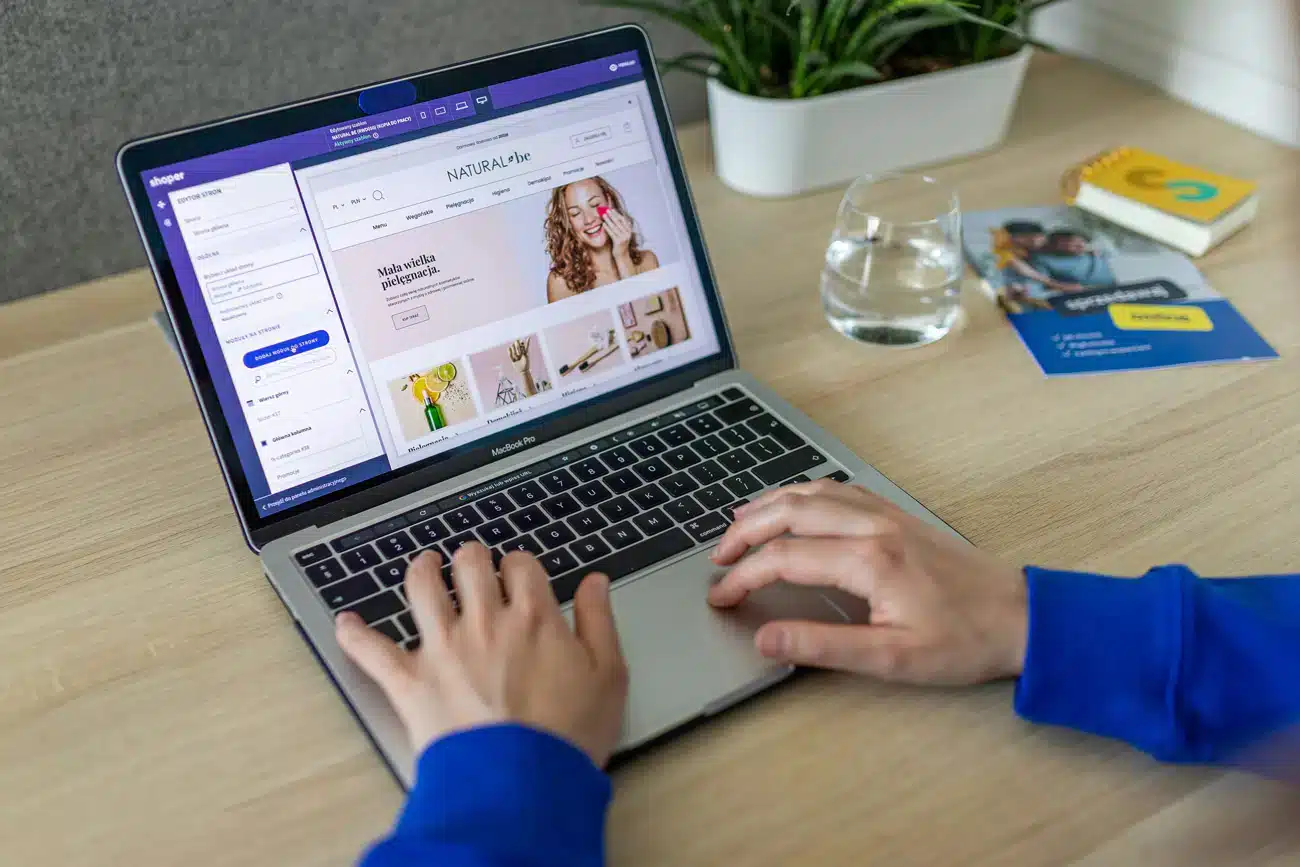

Why Payment Flow Matters for Ecommerce

Payment flow is the journey a payment takes from start to finish. In e-commerce, this includes authorization, authentication, transaction settlement and funding. For more heavily regulated industries, additional fraud screening, compliance and regulatory checks enter the equation to avoid exposure. But the more payment flow there is behind the scenes without customer interaction, the better the customer experience. Thus, merchants need to balance between ease of payment flow and security. Therefore, when payment flow does NOT go smoothly—transactions are declined, they’re overcharged, an unnecessary verification step appears, a regulatory check isn’t accurate—merchants risk a customer walking away from their cart and potential lost revenue. Yet when payment flow is prioritized, merchants can integrate with all necessary payment processing triggers that otherwise might be left out of the equation for fear of adding unnecessary customer friction.

How Merchants Make Their Own High Risk Merchant Account Provider

One of the biggest decisions a high-risk merchant can make for itself is to make its own high-risk merchant account provider. Not all understand what high risk means. The best merchants know what high risk means based on chargebacks, high chargeback ratios, multi-currency transactions and more[2]. The best merchants also have networks with banks that are likely to underwrite more high-risk merchant accounts with the caveat of compliance restrictions. So when a merchant partners with a high-risk merchant account provider, it can avoid the negatives of being flagged or marked as a high-risk merchant in other places[3].

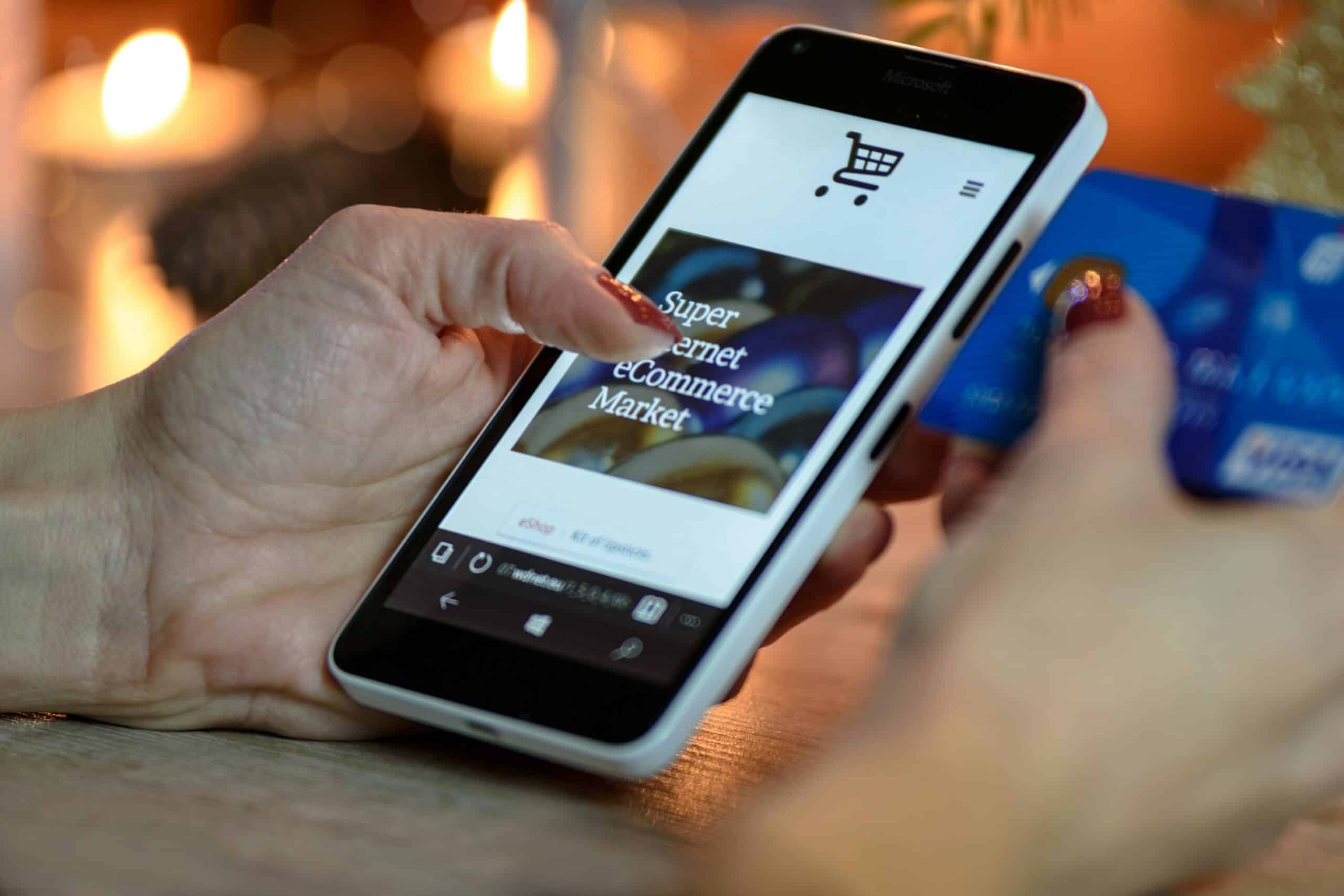

How Merchants Secure Their Transactions

Transaction protection comes from the most secure platforms. Merchants in regulated spaces need PCI compliance protection, any and all security compliance protections to ensure no data is hacked or stolen after payment[4]. Merchant protection comes from chargeback alerts, dispute management programs and PCI DSS compliance support that gives merchants the opportunity to either save revenue left on the table from oversight or protect sensitive information from consumers who would otherwise have concerns.

FAQs

Q: What is an e-commerce transaction in layman’s terms?

A: An e-commerce transaction is the online purchase of a good or service, typically via credit card, debit card or digital wallet.

Q: Why is an e-commerce transaction a high-risk transaction?

A: Some merchants are high risk for an e-commerce transaction due to chargebacks, their propensity for fraud or their industry classification, which may be heavily regulated—CBD, travel, adult services, etc[5].

Q: Who are the high-risk merchant account providers that help with e-commerce transactions?

A: High-risk merchant account providers are payment processors that service high-risk merchants with merchant services, fraud protection, security compliance tools and access to banks willing to create such high-risk accounts.

Q: Do high-risk merchants use the same payment flow as any other e-commerce transaction?

A: Yes and no. It may appear that the same payment flow is used to process any e-commerce transaction; however, high-risk e-commerce merchants are more likely to be dealing with additional fraud checks, compliance checks and monitoring to reduce exposure.

Q: How do merchants integrate their e-commerce payment flow?

A: Through authentication tools like tokenization and fraud detection to complement gateways with high-quality integration to reduce transaction declines and improve customer experience.

Sources

- Investopedia. “Ecommerce Definition and How It Works.” Accessed August 2025.

- NerdWallet. “High-Risk Merchant Accounts: What You Need to Know.” Accessed August 2025.

- Visa. “Chargeback Management Guidelines for Merchants.” Accessed August 2025.

- Deloitte. “The Future of Payments: Innovation and Infrastructure.” Accessed August 2025.

- PCI Security Standards Council. “PCI DSS Quick Overview.” Accessed August 2025.