Managing a high-volume ecommerce operation requires more than just a slick website and good inventory—it demands robust payment infrastructure. From checkout page load times to payment gateway reliability, the ability to accept and manage thousands of transactions per day can make or break an online business. Many ecommerce brands struggle with merchant account limitations, high fees, or poor integration experiences with their backend systems. Choosing the right ecommerce merchant account, and integrating it strategically, plays a vital role in maximizing speed, security, and scalability. This guide walks through everything ecommerce businesses need to know when planning for high-volume payment processing success.

Why High-Volume Ecommerce Needs Specialized Payment Solutions

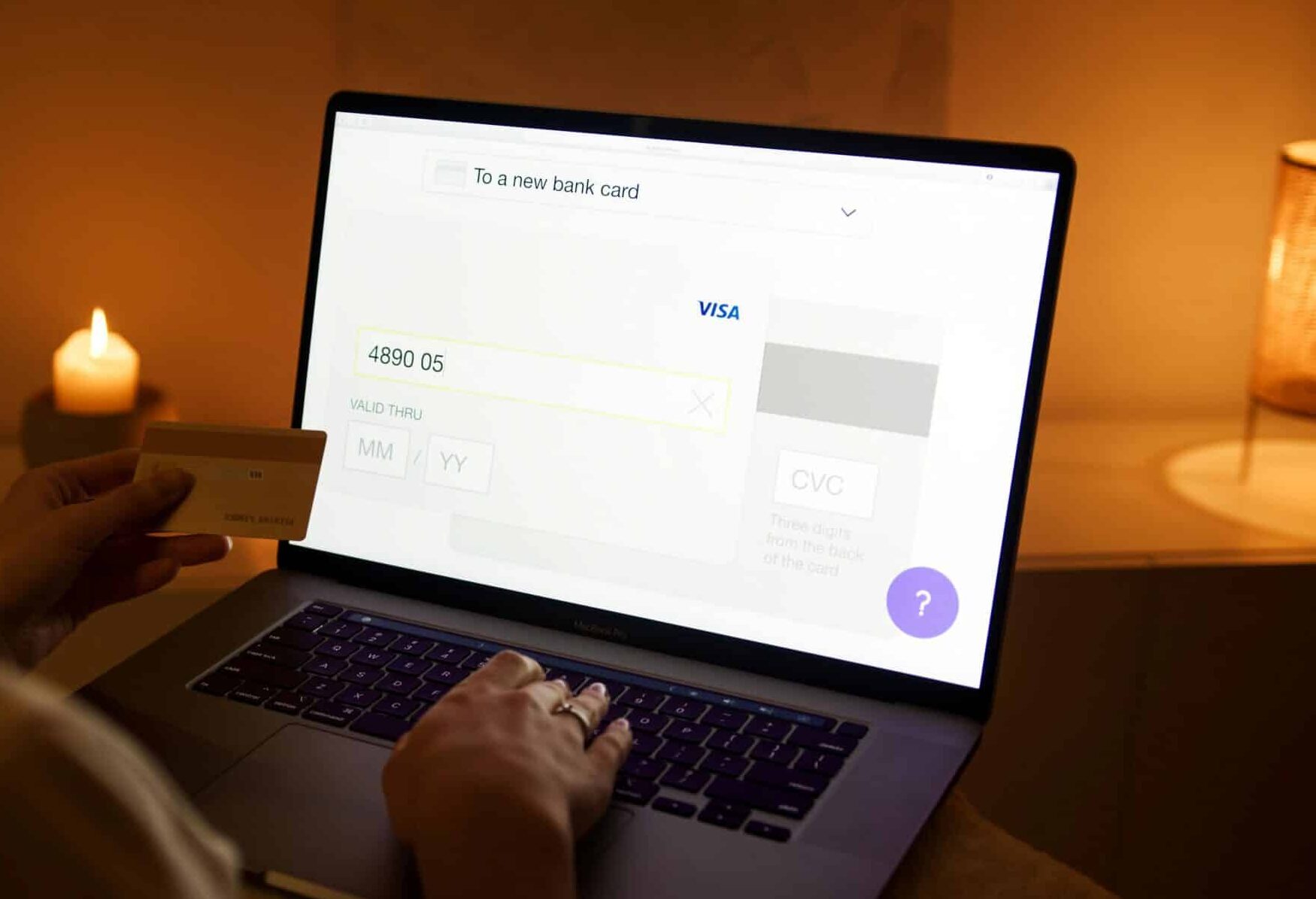

Not all merchant accounts are created equal, especially for ecommerce platforms processing thousands of daily transactions. Standard accounts often lack the infrastructure to handle spikes in activity, multi-channel payments, or international customers. For high-volume sellers, delays, declined payments, or system failures during checkout can result in lost revenue and eroded customer trust[1]. A tailored ecommerce merchant account offers higher processing limits, multi-currency capabilities, and advanced fraud prevention. These features are essential to keeping transactions flowing and customers satisfied while avoiding the pitfalls of underpowered payment setups.

Understanding the Role of Custom Integrations

A high-volume ecommerce operation typically runs on a suite of tools: shopping cart platforms, CRMs, inventory systems, shipping logistics, and analytics dashboards. Your payment processor needs to plug into this ecosystem effortlessly. That’s where custom integrations come in. Using APIs or pre-built plugins, businesses can create seamless transaction flows that sync data across systems. These integrations reduce manual work, improve reporting accuracy, and allow for advanced features like real-time fraud detection or multi-store settlement[2]. When done right, payment customization becomes a competitive advantage—not a tech headache.

Choosing the Right Ecommerce Merchant Account

The best ecommerce merchant accounts for high-volume businesses offer more than low fees—they provide responsive support, modern APIs, and flexible contract terms. Look for providers that support tokenization, have 24/7 uptime monitoring, and offer scalable plans without punitive rate hikes. Also consider geographic reach and currency compatibility if you sell internationally[3]. With the right merchant service provider, high-volume ecommerce brands can maintain stable, secure payment processing even during holiday surges or flash sales.

Payment Nerds: Built for High-Volume Ecommerce Success

At Payment Nerds, we specialize in high-volume ecommerce merchant accounts tailored to your specific needs. We understand the tech stack requirements of growing online stores and offer integrations that work with Shopify, WooCommerce, Magento, and custom-built platforms. Our accounts come with advanced fraud protection, tokenization, fast approvals, and scalable pricing that adjusts with your business. Whether you’re handling hundreds of orders per hour or managing multiple storefronts globally, our infrastructure supports your growth. With Payment Nerds, you get more than a processor—you get a partner who understands ecommerce from the inside out.

Integration Pitfalls to Avoid

One of the biggest risks for high-volume sellers is relying on generic payment gateways with poor API documentation or lagging support. Improper integrations can lead to checkout errors, delayed settlements, or inconsistent data reporting[4]. Avoid working with providers who limit access to backend settings or charge for basic functionality like recurring billing. Always vet the technical documentation, ask for sandbox access, and test for scalability before deploying any integration. The time you invest up front will pay dividends when your traffic spikes and your checkout flows hold steady.

Key Integration Strategies for High-Volume Ecommerce

Use Tokenization for Seamless Repeat Purchases

Tokenization allows customer card data to be stored securely without increasing your compliance burden. This is essential for subscription-based or repeat purchase models common in high-volume ecommerce.

Enable Real-Time Fraud Detection

Integrating with a merchant account that supports real-time fraud screening (like AVS, CVV, and behavioral analytics) can prevent losses and chargebacks before they occur.

Sync Transactions to Your Inventory System

When your payment gateway integrates directly with inventory, you reduce the risk of overselling or order mismatches. Automation ensures your stock levels reflect real-time sales.

Automate Reconciliation with Your Accounting Software

Integrating payments with accounting platforms like QuickBooks or Xero saves time and prevents human error during monthly reconciliation.

Build Checkout Customizations That Reflect Your Brand

The flexibility to build custom checkout flows or embed payment widgets can boost conversions and differentiate your customer experience.

Support Multiple Payment Methods and Currencies

High-volume ecommerce often means global customers. Ensure your integration supports local wallets, regional payment rails, and multiple currencies to avoid cart abandonment.

How High-Volume Merchants Use Payment Data

Ecommerce businesses thrive when they understand their customer payment behaviors. High-volume operations generate a wealth of data: average order values, payment method preferences, fraud attempt rates, and chargeback trends. Integrated merchant accounts allow you to tap into this data in real time. With a solid analytics pipeline, you can identify opportunities to improve conversions, detect risky transactions early, and automate responses to common customer issues[5]. This level of insight turns your payment stack from a passive processor into a powerful business intelligence tool.

Backend developers and integration specialists must align payment systems with operational priorities. This means mapping out API endpoints, ensuring PCI compliance, and configuring payment event tracking. Choose merchant account providers that offer developer portals, clear versioning, and real-time webhook support. Good documentation saves engineering hours, reduces debugging cycles, and increases system resilience. For fast-moving ecommerce teams, payment reliability isn’t optional—it’s mission-critical.

Final Thoughts

Managing a high-volume ecommerce merchant account isn’t just about avoiding downtime—it’s about building systems that support scalability, compliance, and real-time insights. From choosing the right provider to planning airtight integrations, every decision shapes how customers experience your brand. At Payment Nerds, we empower online sellers to handle peak traffic and complex setups with ease. If you’re serious about scaling your ecommerce operation, it’s time to work with a payment partner who understands what high-volume really means.

Sources

- McKinsey & Company. “Global Payments 2024.” Accessed June 2025.

- Forrester. “Ecommerce Tech Stack Trends.” Accessed June 2025.

- Gartner. “Top Considerations for Payment Integrations.” Accessed June 2025.

- PCI Security Standards Council. “Tokenization and Ecommerce Security.” Accessed June 2025.

- Statista. “Average Ecommerce Conversion Rates by Industry.” Accessed June 2025.