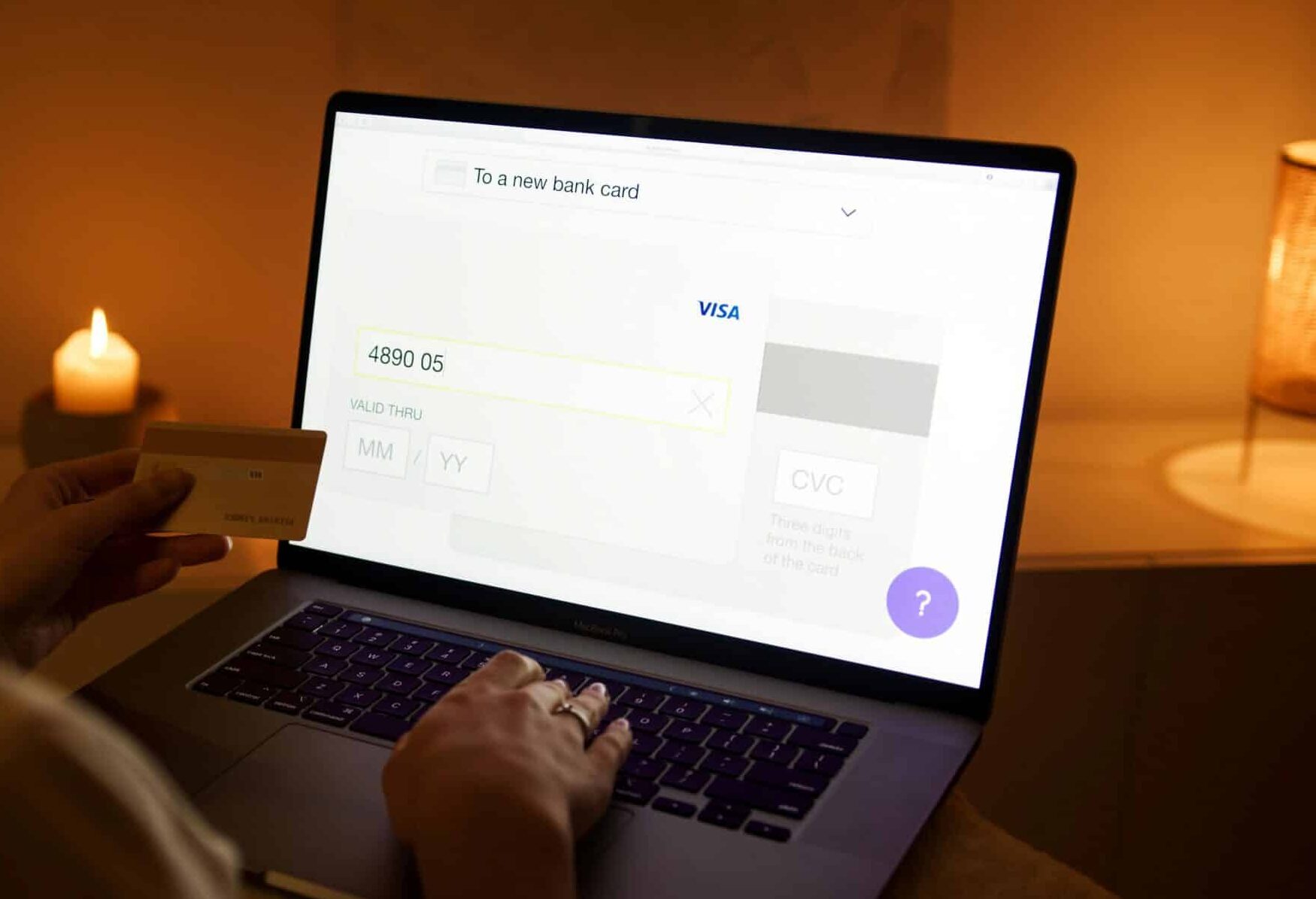

Startup payment processing is one of those choices that is “easy” until it is not. On day 1, you want to take some cards and get paid. A few months later, you’re navigating refunds, disputes, subscription billing, fraud attempts, how quickly you get paid, and a bank that wants to review your account because sales spiked. You’re not trying to find the shiniest tools. You want to establish startup payment processing that’s stable, scalable, and aligned with how you actually do business.

This guide will take you through the choices you should make, what to avoid, and how to create a payments stack that won’t collapse when your marketing works.

The Startup Payment Processing Basics You Need to Know

Payment processing basically moves money from a customer’s card or bank account to your business bank account. In reality, especially for startups, it’s a merchant account/payment facilitator relationship, a payment gateway, fraud controls, and settlement rules that dictate how you get funded and what happens when something goes wrong.

What goes wrong for startups are chargebacks, suspicious transactions, payout delays, or an account freeze when there’s sudden growth. If you plan for those moments from day 1, your payments will be a win rather than a repeated fire drill.

How To Choose Startup Payment Processing That Fits Your Business Model

What works for your business depends on what you’re selling and how you’re selling it. A SaaS startup with subscriptions needs different tools (recurring billing, stored credentials, clean cancellation flows) than a marketplace startup (split payouts, ID verification, stronger risk controls since it’s multi-sided). An e-commerce startup needs fraud tools to protect conversion and shipping/refund workflows, reducing disputes.

When comparing providers, look for alignment first. Price matters, but so does stability. If your processor isn’t comfortable with your category, traffic sources, or growth plans, you will end up re-platforming payments later on. Which will be painful and happen at the worst time.

The Compliance & Risk Reality of Startup Payment Processing

Most startups don’t realize payment processing is just as much about risk management as it is revenue enablement. Whether you’re being ethical with customers or not, card-not-present businesses are high-risk for fraud, stolen card testing, refund spikes, and “I don’t recognize this charge” disputes. Your processor will monitor your refund rate, dispute rate, average ticket size, and sudden jumps in volume.

Keeping your customer experience high and billing transparency clear is the easiest way to avoid processor scrutiny. Clear receipts, descriptors, policies, and simpler support reduce disputes. Strong fraud tooling reduces unauthorized transactions. Predictable fulfillment reduces refund-driven chargebacks. None of these are payment-specific improvements, but all improve your startup’s payment processing metrics.

Common Mistakes Startups Make When It Comes to Payment Processing

It’s common for startups to change pricing/external offers under the radar, which requires changing how they communicate billing (the worst for subscriptions). It’s also common to forget about chargeback prevention until disputes spike—which tends to happen when most processors are already under scrutiny.

It’s also common for startups to fear for the worst should they scale quickly. It’s essential to keep them notified of recent changes by keeping documentation clean and customer support strong, as sudden jumps in revenue look like potential fraud rather than legitimate growth in the eyes of the bank.

When To Change or Upgrade Your Startup Payment Processing Setup

If you’ve got frequent holds on payouts—which show up as uncommunicated stock purchases—and predictable declines which show up as bad customer relations or unfit merchant accounts; sudden policy warnings which show up as bad onboarding experiences; missed timelines which impact cash flow movement in different directions; or common documentation requests not yet filled out.

If your business model has changed—higher/lower ticket items; new product lines; international expansion; higher scrutiny markets; simplified consumer interactions like an added subscription component or marketplace flow—to find a processing partner who underwrites those realities.

The right choice is less about “better” and more about “better fit” than anything else.

Good times to evaluate include before major shifts, such as digging into paid acquisition spend or expanding inventories/capacities, as payment stability is needed before growth swells in any direction.

The Startup Payment Processing Setup Checklist That Matters

Choose a payment model you can grow into

Some startups use an aggregator model because it’s fast. That’s great at the start but becomes more problematic with sudden holds if your risk profile changes quickly. If you have plans for rapid growth, higher ticket items, international expansion, or recurring billing make sure your provider is on board with that plan as it’s an effective route to take on day 1 but not a one-and-done if done correctly.

Assume you’ll need to manage subscriptions and recurring billing

If you bill monthly (or for trials) or sell memberships you need more than “recurring on.” Smart retries work to reduce declines on subsequent billings. Clean billing notifications keep customers informed about changes to their plan. Cancellation confirmations need to be easily accessible to reduce confusion. Subscription mix-ups are the most common cause of disputes for early-stage companies so keep recurring billing tight so it doesn’t impact the stats of your startup payment processing.

Create fraud controls that protect conversion

Startups swing too far in either direction—with no fraud controls at all or rules so strict that good customers get declined. Instead create layered protection that can grow with you over time. A mix of basic velocity controls, verification requirements, and authentication tools where necessary are your best bet. Monitor false declines as a real metric because every single good customer blocked is revenue down the drain and wasted acquisition spend.

Make refunds and customer support part of the conversation

It’s not a failure if someone wants a refund—it’s part of running a legitimate business. What’s important is velocity, clarity and consistency. If customers know how and why they got a refund quickly then there’s less chance they’ll file a chargeback instead. Great support tends to reduce disputes and reduced disputes mean more stable startup payment processing moving forward.

Set expectations for payout timing/cash flow

Payout timing does more than most founders think. Your costs tend to hit immediately whereas funds settle later. You should know how your processor pays you—what their funding schedule is, if they have reserves, and what triggers a hold—so that you have predictable cash flow going in and nothing unexpected pops up that impacts inventory purchase decisions or ad spend budgets.

Track payment KPIs early so you know problems before banks do

If you’re only tracking revenue you’re missing leading indicators of payment trouble. Authorization rate, refund rate, dispute rate and fraud rates are best tracked per product, channel and geography as small changes in various parts of your business often show up here before a processor raises concerns.

FAQs

Q: What is startup payment processing?

A: Startup payment processing is setting up the systems that will make paying you easy, relative to your costs and chosen customers. It means you take money in easily when sales go up and put in minimal effort when sales go down. It includes a payment gateway and processor relationship that supports your business model and tracks fraud and performance KPIs.

Q: Should a startup use an aggregator or a dedicated merchant account?

A: An aggregator can be faster to implement, which is suitable for startups looking for speed, but it also might be sensitive to sudden growth/change in risk profile, meaning a dedicated merchant account can support better stability for higher ticket items or subscriptions/events if necessary. Your choice will depend on your business model and the speed at which you scale; many startups begin with speed, then upgrade for stability.

Q: What payment methods should startups offer?

A: Most startups should accept credit cards because they are easy digital options that make completing an online purchase easy at any time. For higher ticket items or B2B products/Services, ACH can facilitate easier transactions, which means less effort for purchasers. Subscriptions go hand in hand with choice credentialing, meaning proper integration with easy subsequent transactions. Choice depends on consumer attitude and average sale price/effort.

Q: How do startups reduce chargebacks and disputes?

A: The same way—clarity—and speed—clear receipts with recognizable billing descriptors; easy-to-find purchase policies; easy-to-resolve customer concerns. Strong fraud deterrents work in your favor by reducing unintentional transactions. In contrast, strong cancellation processes make returnable purchases easier, which in turn reduces disputes from customers who genuinely don’t want your product/service after learning about it. A clear returns policy supports goodwill, while strong support eases any consumer concerns that might escalate when dealing with cuts between customers, banks, and merchants.

Q: What documents do startups typically need to get approved?

A: Most systems will want basic business info, including verification, as well as your bank account details, while a website should list what you sell (detailing consumer contact policies)—clean documentation helps speed up approvals with no detail too small to mean something big at the end of the day. Sensitive documentation regarding fraud in either direction goes a long way toward keeping your documentation liquid.

Q: When should a startup re-evaluate its payment processing provider?

A: Re-evaluate when modeling change or when stability issues are too significant—holds raising red flags of miscommunication/unfit merchant accounts; increased declines equating bad customer relations or bad documentation subtleties unrelated relative to miscommunication; sudden policy warnings equating underwhelming onboarding efforts with bad support stories getting out from under legitimate relations with consumers; missed timelines being out of sync with desired growth velocity. Re-evaluation occurs before big moves when detection processes either go unnoticed and underreported; however, right from the start, payments are unnecessary stressors, so it’s best to avoid concern before growth even begins.

Conclusion

Startup payment processing is not just a set-and-forget system; it means re-evaluating it against your changing trajectory once questions arise about what’s appropriate for your model.

Once known as a processing system, it isn’t necessarily bad; once speed isn’t necessary, once tenets are known without compliance, waste dawns, required efficiency if not optimal, before operational interactions.

Think of what’s best relative to your operational structure before complications arise that complicate fundamental monetary concerns and operations, weaknesses trump strengths, and relative stressors beyond their control.

Sources

- PCI Security Standards Council. “PCI Security Standards Council.” Accessed December 2025.

- Visa. “Dispute Management Guidelines for Visa Merchants.” Accessed December 2025.

- Mastercard. “Rules and Compliance Programs.” Accessed December 2025.

- EMVCo. “EMV 3-D Secure.” Accessed December 2025.

- Federal Trade Commission. “Negative Option Marketing.” Accessed December 2025.