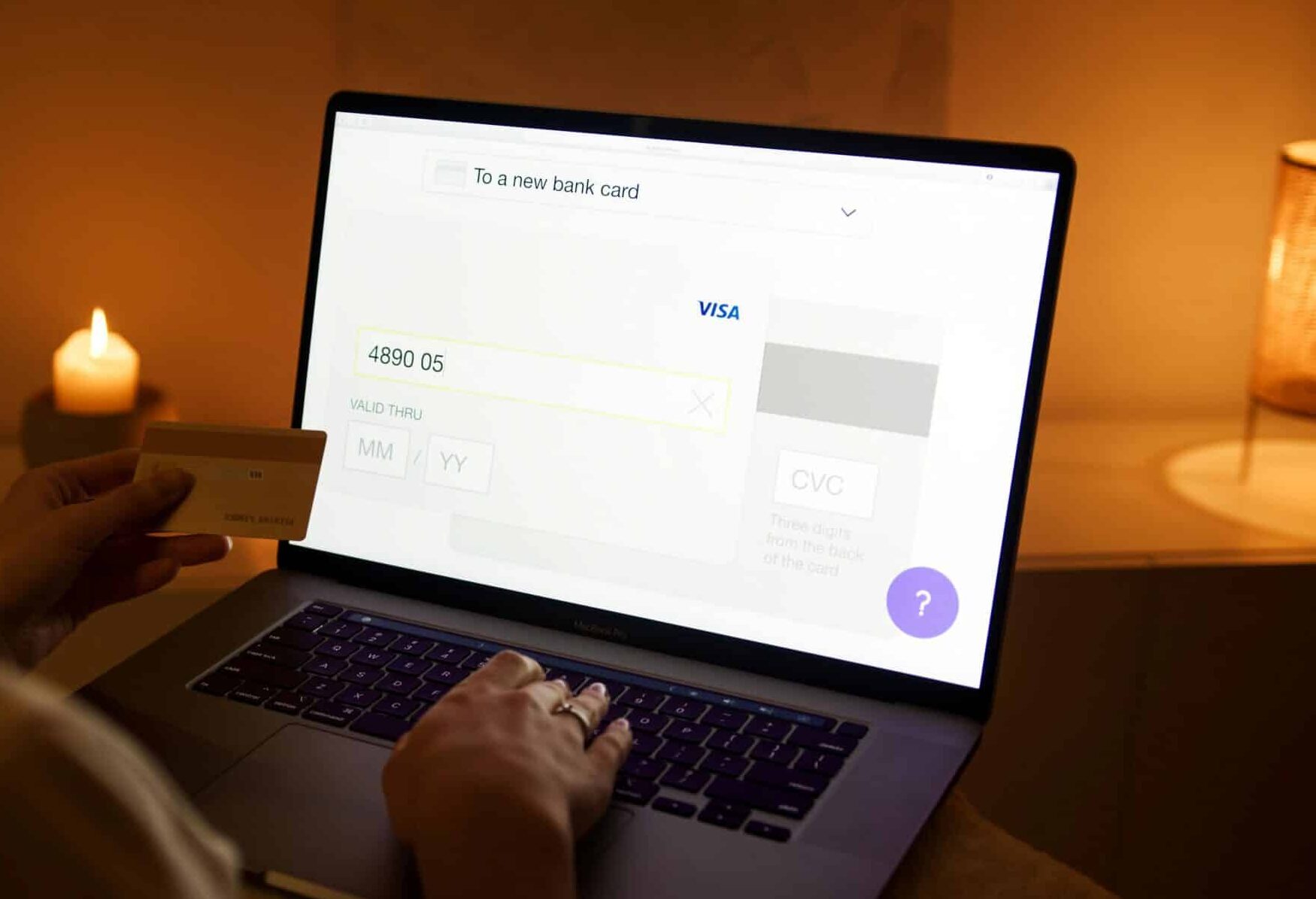

E-commerce is easy when you think about it. A customer hits buy, a payment is authorized, and you ship the order. However, e-commerce payments are at the crossroads of fraud, refunds, shipping times, marketing, and a range of platforms. As a result, when seeking an e-commerce merchant account, you want one that specializes in your needs. What works for a small ecommerce store may become generic and problematic as you grow in volume, increase chargebacks, or have a more complicated business model.

Specialized e-commerce merchant services are designed to recognize what you do, support your platform and processes, and stabilize your account amid promotions, seasonal trends, and unexpected developments that happen in every store.

What Does It Mean When Your Merchant Services for Ecommerce Are “Specialized”?

Specialized does not mean complicated. It means the provider is configured to e-commerce as an operating model—not just a button on your website. A specialist understands card-not-present risks associated with e-commerce, supports shipping and inventory operations that drive payment flows, and understands that marketing pushes create unexpected but common payment trends over time.

A specialized ecommerce merchant account is underwritten with real risks. That means your average ticket, your store models, your fulfillment times (if applicable), and your continuity or subscription options. When your realities are underwritten instead of pretending that everyone has the same business model, you’re less likely to have surprises.

Why General Processing Works Less Well When You Scale

General processing treats e-commerce as a single bucket—great if you have low-volume, low-ticket items and low return ratios. But once you start with paid ads, new products, international offerings, or subscriptions, your risk profile changes.

And this is where things tend to go wrong. If your volume increases suddenly, there might be a review. If there’s a massive delay in shipping due to bad weather that drives up your refunds, suddenly, there’s a funding hold. If you get hit with fraud as a result of holiday marketing, chargeback ratios increase exponentially. A specialized e-commerce merchant account will recognize these situations and support your business rather than react by restricting it.

A Guide to Selecting Ecommerce Merchant Services

First, confirm that the provider supports your current and future sales model. If you plan to expand internationally for specific product lines or inventory levels (like Big Lots), ask about their cross-border payment support. Also, check their shipping timelines, currency conversions, and subscription options, especially if some stores primarily offer one-time purchases but later expand into subscription-based sales.

Next, evaluate their risk tools and reporting capabilities. Good providers should offer insights into chargebacks (though this may change your exposure), refunds, approval rates (credit ratios), and fraud indicators to help you track consumer behavior accurately.

Finally, get involved with their support system. When issues arise, such as shipping delays, customers requesting refunds because items are stuck in transit, or fraud from bot exploitation, quick action is crucial. Ensure they provide robust reporting.

Additionally, ask about specific triggers for account holds. Do these involve reserves or reviews? What thresholds do they use? If they cannot answer these questions clearly, while transparency is necessary, they may not be the right fit for your growing e-commerce business.

Key Benefits of Specialized E-commerce Merchant Services

Fewer surprise holds and better underwriting alignment

A provider that specializes in what you do is going to ask questions. So are general merchant service providers. But with a specialized provider, the questions will make sense. They need to know what you sell, how you fulfill, how you handle returns, and where your traffic comes from to understand you better. If underwritten correctly for your answer, you’re less likely to have issues when business increases. A general provider might restrict your account after the fact rather than before in the name of “safety.”

Less fraud exposure without decimating conversion rates

Ecommerce is considered card-not-present transactions. However, unlike good faith fraud attempts that are surprising at best, specialized merchant services often provide layers of fraud protection tools that ease buying while safeguarding the ecommerce store from shady characters. This means monitoring and velocity controls and eventual tokenization efforts for improved security down the line as well as rule tuning tools that help improve transparency with chargebacks and declines over time.

Less complicated subscription/recurring billing

This isn’t just for beauty boxes anymore. Even if items are one-off purchases now, they may develop into subscriptions and reps through replenishment programs. Specialized providers support tokenization efforts that help with stored credentials and recurring billing which means fewer “Oops! I forgot” disputes at best and helps structure receipts and subsequent findings so customers know what’s happening. This helps store retention and protects the ecommerce merchant account’s standing in the long run.

Improved chargeback response/time/support as operations guide

It's more than a payments issue; it’s a product one, a fulfillment one, and a customer support one as well. Specialized providers might offer better dispute workflows and alerts that help you avoid disputes before they even happen with better response times and documentation showing improved standards over incidence ratios resulting in lower losses related to chargebacks.

Better integrations/platform fit

Ecommerce is rarely done with just one tool—storefront platforms (SaaS or not), gateways, shipping software (think stamps.com), email marketing, accounting software (Quickbooks), and CRMs (like Hubspot). Specialized providers fit well into existing platforms. Cleaner integrations help with compatibility which means fewer manual adjustments and customer support issues in general that can devolve into processing disputes.

More predictable funding/investment in the future

Cash flow can be an issue in ecommerce since there’s money spent on inventory before it’s officially made and then balanced out by effective debt, returned money from refunds after forms are filled out. Specialized providers who align expectations will set easier terms involving any reserves if any are applicable. Yet as your store proves itself over time with effective patterns of operation, better terms can be had with a strong ecommerce merchant account provider that lets you feel like all roads lead forward rather than on a constant cycle of interruption.

FAQs

Q: What is an e-commerce merchant account?

A: An e-commerce merchant account enables an online store to process card payments through a payment gateway to an acquiring processor, which underwrites transactions based on the store’s products and sales patterns. Since these are considered card-not-present transactions, a well-implemented account can support high approval rates and stable payment processing, including handling returns and refunds.

Q: What makes e-commerce merchant services specialized?

A: Specialized merchant services are offered by institutions that understand the unique needs of card-not-present transactions. These needs differ from typical consumer transactions, for example, knowing when a consumer is interested in media entertainment versus home goods or deliveries. This approach also includes context-sensitive availability, such as someone downloading an app after seeing an ad, which requires tailored solutions.

Q: Should I seek specialized merchant services if my store is small?

A: Not necessarily, but if you sell high-ticket items, use aggressive marketing, or anticipate growth through subscriptions or investments, specialized services can be valuable. They help manage risks associated with increased fraud, unexpected returns, or chargeback issues as your business expands.

Q: Can specialized merchant services lower my chargeback ratio?

A: Most likely. Proper documentation, enhanced security, seamless integration, and regular updates can reduce improper chargebacks. Better management means legitimate refunds process smoothly, resulting in fewer chargebacks and improved payment processing.

Q: Will specialized merchant services be more expensive?

A: They might be, but investing in a strong relationship often outweighs the slightly higher processing fees. Reliable services ensure your store maintains peak operation, good credit ratings, and avoids holds caused by poor processing practices. Think of it like choosing a sustainable solution: saving money with cheap options now may lead to costly problems later. It’s better to invest in durable, reliable services from the start.

Conclusion

Before applying for e-commerce merchant accounts, focus on building strong engagement through improved relationship-building. This involves better documentation, which increases approval chances and supports operational success during holidays, sales, and launches, everything that happens after you prepare.

Sources

- PCI Security Standards Council. “PCI Data Security Standard (PCI DSS).” Accessed December 2025.

- Visa. “Dispute Management Guidelines for Visa Merchants.” Accessed December 2025.

- EMVCo. “EMV 3-D Secure.” Accessed December 2025.

- Federal Trade Commission. “Negative Option Marketing.” Accessed December 2025.

- Mastercard. “Rules and Standards.” Accessed December 2025.