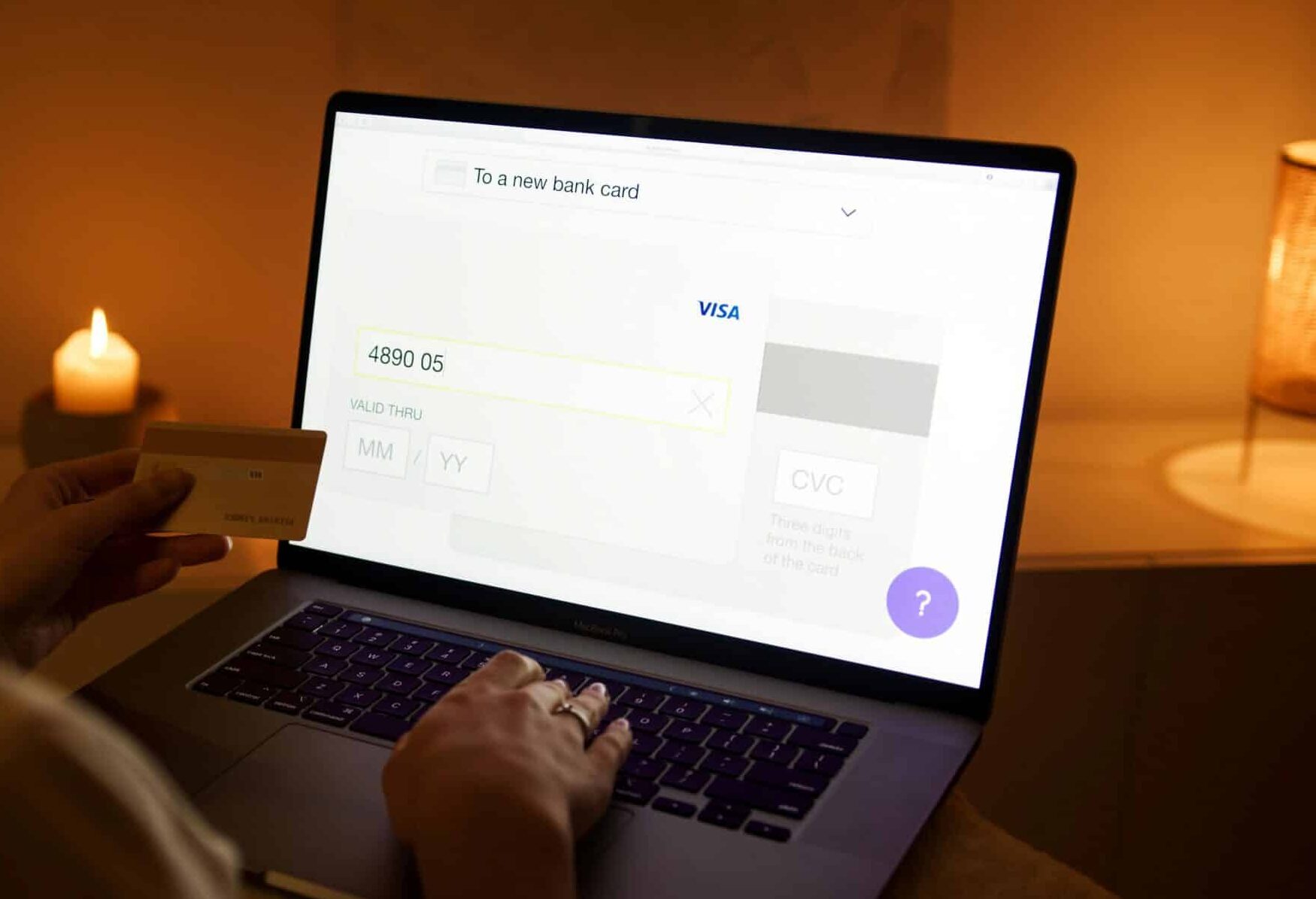

You don’t have to abandon your business aspirations just because of bad credit, especially regarding payments. While banks and lenders may shy away from approving individuals with less-than-stellar payment histories, many merchants still thrive, with designated merchant account options available for high-risk, low-credit entrepreneurs. To accomplish getting a merchant account with bad credit, however, you must understand what payment processors are looking for, what forms of documentation will be necessary, and how to present your business as low-risk despite previous financial mistakes. This guide will summarize actionable steps you can take to cut the chances of failure and ensure an effective transition to reliable payment processing, despite a rocky credit history.

Why Bad Credit Impacts Your Chances of Getting a Merchant Account

Credit scores serve as bankers’ and processors’ risk profiles. If your score indicates a bankruptcy, charge-offs, collection accounts, late payment history or maxed-out lines of credit, you’re seen as a risky merchant. Payment processors worry that merchants out of money will refuse to pay chargebacks or breach the merchant account terms of service agreement due to desperate financial situations[1]. Therefore, payment processors either deny your application, render rigid terms or impose high reserve requirements. Yet it’s not solely your credit history that matters. Payment processors also assess your chargeback ratio, type of business, industry and required paperwork. Thus, having bad credit doesn’t equal doom for your merchant account, but rather proactive approaches.

What Do Processors Look For (Other Than Credit)

When seeking a merchant account with poor credit, payment processors look at the business overall and its history of processing transactions. They care about monthly volume, average ticketing, refunds, and chargebacks. They’ll examine your website, the legitimacy of your goods or services, customer service offerings, and banking relationships. Some processors require bank statements and tax returns to determine how much income is available. If processors see that a business is run responsibly, even without a stellar credit score, they can still get a merchant account with the right lender fit[2].

What Merchant Account Options Are Available?

Merchant account options for those seeking merchant account bad credit/high-risk merchants include offshore merchant accounts, domestic high-risk providers, and third-party aggregators. Offshore accounts are more lenient but come with longer chargeback windows and reduced fraud protection. Domestic high-risk providers may have rolling reserves but, in the end, help you stay compliant[3]. Aggregators like PayPal or Square are easier to access but often blacklist all merchants who accrue too many chargebacks or operate untraditional businesses. Therefore, work with a payment processor that explicitly advertises the option to acquire such merchant accounts for merchant accounts easy access, they will adjust your merchant account agreement based on risk assessment instead of denying your application.

Key Documents Required for Application

Even if you have a bad credit score, good documentation may greatly enhance your chances for approval. Be prepared to submit your business license, banking details, prior processing statements (if any), product details and return policies, and perhaps your EIN or tax number. Also, for those running eCommerce businesses, it’s essential that your website is clean, with accessible policies and customer service opportunities. Processors want to know you’re transparent about what you do, your experience, and that you won’t jeopardize them or their customers. In addition, if you have a business partner with better credit, apply with them, as this will enhance your underwriter’s position[4].

The Process of Getting a Merchant Account With Bad Credit

Research Processors Who Accept Bad Credit

Not all processors are interested in merchants with bad credit, as some bad credit merchant accounts come with too much risk. Find processors who have high-risk or second chance merchant accounts.

Fix Your Website

Your professional business website and/or eCommerce site should officially be launched on an HTTPS secure site. It should contain specifics about what it sells/offers, return policy, customer service offerings, etc. Providing this information (and accurate info) lowers processor risk.

Compile a Business Packet

Prove your legitimacy to the underwriter with a comprehensive business overview packet of what you've done so far and how you plan for the future. Include backup documentation that shows business stability and potential expansion.

Offer a Reserve Account

Many high-risk processors will approve bad credit accounts as long as you're okay with a rolling reserve, an amount held back for X time until chargebacks are determined.

Monitor and Reduce Chargebacks

Demonstrate you're committed to combating fraud. Utilize anti-fraud options, have proper refund procedures in place, and if you've processed elsewhere, show that you have a low dispute rate.

Be Transparent During Underwriting

Share what you can about your credit history why you've taken measures to reduce risk. Transparency may go a long way for approval, even with bad credit.

FAQ

Q: Can I get a merchant account with bad credit?

A: Yes, but it has to be via high-risk providers or bad-credit-friendly processors. These individuals look beyond a credit score for risk and evaluate business practices, documentation and more within the industry.

Q: Does my personal credit affect my business merchant account?

A: It can, especially if you’re a sole proprietor. But good business documentation helps, along with low-risk processing to lessen personal credit history issues[5].

Q: What is a rolling reserve, and will I need one?

A: A rolling reserve is a percentage of upward processed funds temporarily held by your processor to protect against disputes. It’s common for bad credit accounts or high-risk accounts.

Q: Will I pay more for bad-credit merchant accounts?

A: Usually. Slightly higher transaction fees, monthly processing fees or a reserve may be in store. Many of these can be renegotiated down after time in processing compliance.

Q: How can I improve my chances of being approved?

A: Submit extensive documentation, include a fraud prevention policy, have a legitimate online presence and professionalism and transparency in your application process.

Q: Which industries are more likely to be approved if they have bad credit?

A: Digital goods, coaching, consulting and retail are more easily approved as opposed to fields that incur high refund potential or are highly regulated, like travel or nutraceuticals.

Conclusion

Obtaining merchant accounts with bad credit doesn’t have to be like navigating a gauntlet of denials and slammed doors. With the right approach and the right processor, you’ll be well on your way to merchant account solutions that work for your present credit viability while paving the way for a healthier financial future. Here at Payment Nerds, we take pride in matching merchants with credit concerns with reputable processing partners who see the bigger picture, not just a score on a credit report. When you’re ready to start processing payments and take your business to the next level, the solution may be closer than you think.

Sources

- Visa. “Merchant Credit Standards and Risk Assessment.” Accessed July 2025.

- Federal Trade Commission. “Credit Reports and Business Applications.” Accessed July 2025.

- Mastercard. “Underwriting Guidelines for High-Risk Businesses.” Accessed July 2025.

- Forbes. “How to Get a Merchant Account With Bad Credit.” Accessed July 2025.

- Merchant Maverick. “Best Merchant Account Providers for Bad Credit.” Accessed July 2025.